-

Články

Top novinky

Reklama- Vzdělávání

- Časopisy

Top články

Nové číslo

- Témata

Top novinky

Reklama- Videa

- Podcasty

Nové podcasty

Reklama- Kariéra

Doporučené pozice

Reklama- Praxe

Top novinky

ReklamaFood Pricing Strategies, Population Diets, and Non-Communicable Disease: A Systematic Review of Simulation Studies

Background:

Food pricing strategies have been proposed to encourage healthy eating habits, which may in turn help stem global increases in non-communicable diseases. This systematic review of simulation studies investigates the estimated association between food pricing strategies and changes in food purchases or intakes (consumption) (objective 1); Health and disease outcomes (objective 2), and whether there are any differences in these outcomes by socio-economic group (objective 3).Methods and Findings:

Electronic databases, Internet search engines, and bibliographies of included studies were searched for articles published in English between 1 January 1990 and 24 October 2011 for countries in the Organisation for Economic Co-operation and Development. Where ≥3 studies examined the same pricing strategy and consumption (purchases or intake) or health outcome, results were pooled, and a mean own-price elasticity (own-PE) estimated (the own-PE represents the change in demand with a 1% change in price of that good). Objective 1: pooled estimates were possible for the following: (1) taxes on carbonated soft drinks: own-PE (n = 4 studies), −0.93 (range, −0.06, −2.43), and a modelled −0.02% (−0.01%, −0.04%) reduction in energy (calorie) intake for each 1% price increase (n = 3 studies); (2) taxes on saturated fat: −0.02% (−0.01%, −0.04%) reduction in energy intake from saturated fat per 1% price increase (n = 5 studies); and (3) subsidies on fruits and vegetables: own-PE (n = 3 studies), −0.35 (−0.21, −0.77). Objectives 2 and 3: variability of food pricing strategies and outcomes prevented pooled analyses, although higher quality studies suggested unintended compensatory purchasing that could result in overall effects being counter to health. Eleven of 14 studies evaluating lower socio-economic groups estimated that food pricing strategies would be associated with pro-health outcomes. Food pricing strategies also have the potential to reduce disparities.Conclusions:

Based on modelling studies, taxes on carbonated drinks and saturated fat and subsidies on fruits and vegetables would be associated with beneficial dietary change, with the potential for improved health. Additional research into possible compensatory purchasing and population health outcomes is needed.

Please see later in the article for the Editors' Summary

Published in the journal: . PLoS Med 9(12): e32767. doi:10.1371/journal.pmed.1001353

Category: Research Article

doi: https://doi.org/10.1371/journal.pmed.1001353Summary

Background:

Food pricing strategies have been proposed to encourage healthy eating habits, which may in turn help stem global increases in non-communicable diseases. This systematic review of simulation studies investigates the estimated association between food pricing strategies and changes in food purchases or intakes (consumption) (objective 1); Health and disease outcomes (objective 2), and whether there are any differences in these outcomes by socio-economic group (objective 3).Methods and Findings:

Electronic databases, Internet search engines, and bibliographies of included studies were searched for articles published in English between 1 January 1990 and 24 October 2011 for countries in the Organisation for Economic Co-operation and Development. Where ≥3 studies examined the same pricing strategy and consumption (purchases or intake) or health outcome, results were pooled, and a mean own-price elasticity (own-PE) estimated (the own-PE represents the change in demand with a 1% change in price of that good). Objective 1: pooled estimates were possible for the following: (1) taxes on carbonated soft drinks: own-PE (n = 4 studies), −0.93 (range, −0.06, −2.43), and a modelled −0.02% (−0.01%, −0.04%) reduction in energy (calorie) intake for each 1% price increase (n = 3 studies); (2) taxes on saturated fat: −0.02% (−0.01%, −0.04%) reduction in energy intake from saturated fat per 1% price increase (n = 5 studies); and (3) subsidies on fruits and vegetables: own-PE (n = 3 studies), −0.35 (−0.21, −0.77). Objectives 2 and 3: variability of food pricing strategies and outcomes prevented pooled analyses, although higher quality studies suggested unintended compensatory purchasing that could result in overall effects being counter to health. Eleven of 14 studies evaluating lower socio-economic groups estimated that food pricing strategies would be associated with pro-health outcomes. Food pricing strategies also have the potential to reduce disparities.Conclusions:

Based on modelling studies, taxes on carbonated drinks and saturated fat and subsidies on fruits and vegetables would be associated with beneficial dietary change, with the potential for improved health. Additional research into possible compensatory purchasing and population health outcomes is needed.

Please see later in the article for the Editors' SummaryIntroduction

Non-communicable diseases (NCDs) including heart disease, stroke, diabetes, cancers, and chronic respiratory disease are the leading preventable causes of global morbidity and mortality [1]. Furthermore, these diseases place substantial burden on national economies, contribute to poverty, and are a major cause of health inequalities [2]–[4]. Nutrition-related risk factors such as low fruit and vegetable intake and high saturated fat and sodium intakes are causative risk factors for NCDs. Improving population diets and reducing sodium intake were recently identified as two priority areas for action at the United Nations High Level Meeting on Prevention and Control of NCDs in September 2011 [5]. If these changes in population diet take place, the interventions will support the global goal of reducing NCD death rates and averting tens of millions of premature deaths within the next decade [3].

Price is one of the most important factors influencing food choice [6], and pricing strategies (food taxes and subsidies) have been proposed as a means to improve population diets and reduce rates of obesity and NCDs. Food taxes are also of interest to national and state governments because of their revenue-raising potential. Such policies have been used successfully in other areas of public health [7], the best example of which is tobacco smoking, where price increases in cigarettes led to immediate and permanent decreases in sales and in the global prevalence of smoking [8],[9]. Nonetheless, despite differential application of goods and services tax or value added tax to food in some countries [10], the application of such taxes is largely driven by revenue-raising imperatives, and food pricing policy with the aim of improving population diets is a relatively untested concept.

In 2008 the World Health Organization recommended that policy be used to influence food prices “in ways that encourage healthy eating” [11]. Economic theory suggests that increasing the price of foods high in nutrients counter to health (such as excess energy [caloric content], sodium, sugar, and saturated fat) and/or reducing the price of foods high in nutrients that are pro-health (such as fibre and unsaturated fat) may improve the nutritional quality of diets consumed, raise revenue to support other population health interventions or government expenditures, and send a clear message to consumers about which foods are healthier [12].

The effects of altering the price of food on purchase volumes are estimated using price elasticities (PEs). Own-PEs refer to changes in the demand of a good/food due to changes in its own price; cross-PEs refer to changes in the demand of a good/food in response to price changes in another related good/food. For example, a price increase in butter is likely to produce a reduction in butter purchases (own-PE), but also displacement or compensatory purchasing of margarine as a substitute (cross-PE). The higher the PE, the more purchase volume changes as a result of price changes. The magnitude of a cross-PE depends on whether a non-targeted good/food is a suitable substitute for the good/food targeted for a tax or subsidy. However, sometimes unintended compensatory or displacement purchasing may occur and undermine the health objective of the tax or subsidy. For example, individuals faced with a subsidy on fruits and vegetables may purchase more fruits and vegetables (own-PE), but also purchase more foods high in saturated fat and sodium (cross-PE).

The possibility of compensatory purchasing is one concern with food taxes and subsidies. Another is that taxes may be regressive by disproportionately affecting lower income households [12], if lower income households spend a greater percentage of their household budget on food items that are taxed (or less on food items that are subsidised), even allowing for changes in purchasing behaviour due to the pricing intervention. Nonetheless, a higher PE (both own and cross) among lower income households could mitigate such concerns, and even help reduce health disparities [13].

Despite increasing interest, evidence of the effect of food pricing strategies on consumption, health, and disease is limited. Pricing interventions are difficult to evaluate using traditional robust research methodologies, such as randomised controlled trials (RCTs), because pricing strategies are difficult to undertake in the real world setting and RCTs are generally too short to determine long-term health effects. Nonetheless, two such pragmatic RCTs have been undertaken (one in the United States [14] and one in New Zealand [15]), and three are about to start (two in Australia [16] [J. Brimblecombe, personal communication] and one in the Netherlands [17]). Both of the completed trials found that subsidies on fruits and vegetables increased fruit and vegetable purchases (one of the studies evaluated effects on purchases of other food groups: no significant differences were found).

The best evidence for a change in the price of food improving health and disease would be provided by RCTs, with factors measured with accuracy and precision across multiple heterogeneous populations. However, as this is an unrealistic expectation, evidence may be sought from simulation models, which help to bridge the gap between empirical research and long-term health outcomes [18]. Simulation modelling involves the development of causal diagrams and policy-oriented computer models that use a collection of mathematical equations to quantify the relationships between interventions and particular outcomes of interest [18],[19]. Such models simplify the complex ecological system surrounding an intervention to a few quantifiable possibilities.

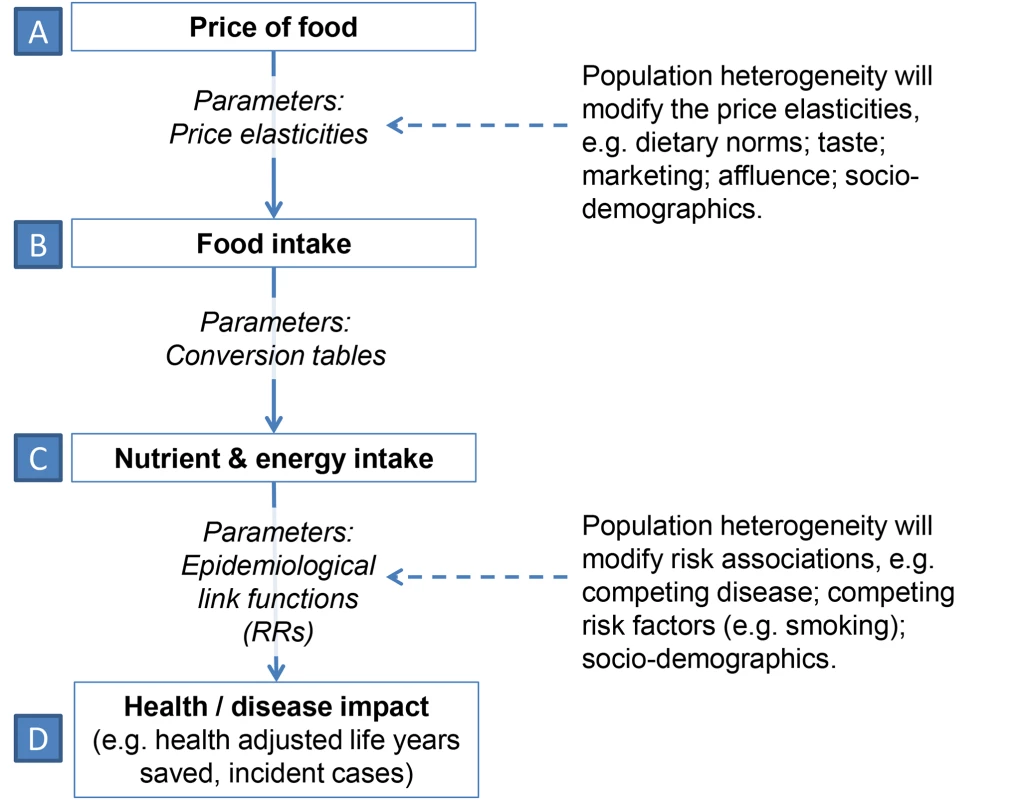

Figure 2 shows a causal diagram illustrating the relationships between food price and health or disease. Four steps, or types of variables, are included: food price, food intake, nutrient and energy intake, and the effect on health or disease. These steps are linked together (the “model structure”) by assumptions, about which there is some uncertainty. “Parameters,” or “inputs,” such as PEs and nutrient conversion tables (about which there is also some uncertainty), are entered into the model. Mathematical predictions of how the change in one or more variables influences another or multiple variables in the next step, in this case, for example, relative risks, are referred to as link functions. Importantly, population heterogeneity can alter the magnitude of these parameters. For example, dietary norms and tastes can alter PE values across populations and sub-populations. For wealthy populations for which food is a small proportion of total expenditure, food intake may not be particularly sensitive to food price. Cultural norms about diets also mean some foods are considered “staples” and may not alter in purchase volumes with price. In this case, such foods are relatively inelastic.

One systematic review of simulation studies exploring the association of food price with consumption, health, and disease has been undertaken to date (n = 16 studies) [20]. This previous review concluded that food taxes and subsidies have the potential to influence food consumption and health considerably, particularly when such taxes/subsidies are large (∼15% of product price or more) [20]. Other reviews of pricing strategies have reached similar conclusions [19],[21]–[24]. However, these and the previous systematic review provided narrative summaries, and although such summaries are useful, they are not able to provide policy makers with a clear message regarding the likely magnitude and direction of effects on food consumption and health. Moreover, reviews to date have not comprehensively addressed issues of quality in the PEs or epidemiological models, or specifically focused on the impacts of pricing strategies for different socio-economic groups. Furthermore, because of the recent rise in global food prices and increasing interest in food pricing strategies, a number of simulation modelling studies have been undertaken in recent years that were not included in the previous systematic review (the current review identifies 15 additional studies). Therefore, a comprehensive, updated systematic review of simulation studies is timely and important.

The overall aim of this systematic review was to assess and quantitatively evaluate (where possible) the potential of food taxes and subsidies to improve population diet (intake or purchases), improve health (risk factors such as cholesterol and blood pressure), and reduce NCDs in member countries of the Organisation for Economic Co-operation and Development (OECD), as estimated with simulation models. Specific objectives were to assess: (1) the magnitude of the association of food taxes and subsidies with changes in food and nutrient intake, (2) the magnitude of the association of taxes and subsidies with health and disease states, and (3) the evidence for heterogeneity in these findings by socio-economic position. Objective 1 is driven largely by PE estimates used in the simulation model, and objective 2 is additionally driven by the epidemiological component. Therefore, quality assessments of these two components of the simulation models were included. In addition to providing, to our knowledge, the first pooled estimates of the association of food pricing strategies with consumption, health, and NCDs, we recommend better designs, assessments of quality, and improved reporting of future simulation studies.

Methods

The methods used to systematically collect studies for this review were based on those outlined in the Cochrane Handbook for Systematic Reviews of Interventions [25]. However, meta-analysis techniques were not used in combining the findings of simulation studies, as such models use a variety of structures and mathematical techniques to estimate the impact of an intervention, in contrast to, for example, RCTs, which are amenable to meta-analysis because they follow one relatively standard technique or method. Nonetheless, where possible, estimates of PEs and their immediate impacts on consumption (from epidemiological models) were synthesised as one important aspect of results. Further details are provided in “Data Extraction and Synthesis” below. A protocol for this review has not been published separately. The PRISMA checklist is provided as Text S1.

Selection of Studies

Simulation modelling studies published in peer-reviewed journals or as scientific reports were included. The following definition was used for defining eligible simulation models to include in this review: a study that uses a collection of mathematical equations to quantitatively map the relationships between food price change and resultant change in at least one of the following: food consumption (intake or food purchases), health status (biological risk factors such as blood pressure and cholesterol), and NCDs (modified from [19]). This review focused on the potential of food pricing strategies to improve the quality of population diets and associated health and NCD outcomes. As such, the outcomes of interest were largely associated with the consequences of over - rather than under-nutrition. For example, health outcomes included blood cholesterol and blood pressure, and NCD outcomes included obesity, cardiovascular disease (CVD), and cancer. To exclude studies where under-nutrition was the primary driver of food pricing strategies, the review was limited to studies undertaken in one of the 34 member countries of the OECD [26]. As explained above, RCTs and observational studies were not included, although such studies will have contributed substantively to the development of the simulation models.

Search Strategy and Data Sources

Major electronic databases (Medline, Embase, and Food Science and Technology Abstracts) were searched for relevant journal articles published between 1 January 1990 and 24 October 2011. The year 1990 was chosen to ensure included studies were relevant to current dietary habits and practices and mathematical models. The search strategy used for Medline is presented below; this search strategy was modified accordingly for other databases. Searches were limited to articles published in English. Relevant articles and grey literature, including economic literature, technical reports, and working papers, were also identified through Google Web and Google Scholar, and by searching the bibliographies of included studies. Enquiries were also made to key experts in the field. One author (H. E.) assessed all abstracts for suitability for inclusion; a second author (C. N. M.) was available to address any queries.

Search strategy for Medline

The following search algorithm was used: (1) exp Food/, (2) food$.mp, (3) exp Diet/, (4) nutrition$.mp., (5) exp Eating/, (6) exp Food Habits/, (7) food purchas$.mp., (8) 1 or 2 or 3 or 4 or 5 or 6 or 7, (9) price$.mp., (10) exp Nutrition Policy/or exp Health Policy/, (11) subsid$.mp., (12) discount$.mp., (13) cost$.mp., (14) taxes/or tax exemption/, (15) exp “Cost Control”/, (16) pricing strateg$.mp., (17) 9 or 10 or 11 or 12 or 13 or 14 or 15 or 16, (18) exp Computer Simulation/, (19) simulation model$.mp., (20) exp Systems Analysis/, (21) systems model$.mp., (22) micro simulation$.mp., (23) macro simulation$.mp., (24) simulat$.mp, (25) 18 or 19 or 20 or 21 or 22 or 23 or 24, (26) 8 and 17 and 25, (27) limit 26 to (English language and year = “1990–Current”).

Data Extraction and Synthesis

The following data were extracted for all included studies: first author, year, country, food groups included in the simulation model, interventions modelled, datasets used, inclusion of lower socio-economic groups, outcomes, impact, quality, and feasibility issues addressed (definition of healthy/less healthy foods, and format and magnitude of tax/subsidy). Assessment of the quality of included studies focussed on two components. The first component addressed the PE estimates, in particular, whether both own - and cross-PEs were calculated/sourced within a complete demand system (i.e., including all food groups), whether PEs were developed using long-run input data (definition provided below), whether appropriate PE input data were used (relevant country), and whether uncertainty of PE was addressed (i.e., through reporting of error or uncertainty). Where relevant, the application of differential PEs for socio-economic sub-groups was also recorded. The second component addressed the epidemiological model components or parameters/inputs and link functions used in the simulation, in particular, whether the study used valid and appropriate consumption data for the country of interest, whether the study attempted to validate or calibrate the model, and whether parametric uncertainty or variation of the model inputs was addressed (e.g., through sensitivity analyses). It is important to note, though, that no attempt was made to undertake a thorough assessment of the structural uncertainty of the models, including the selection of relative risk functions.

Further description of how these quality dimensions were defined and assessed, including the types of inputs used for the models, is provided in Text S2.

Assessment of studies as high quality

High-quality studies were defined as those meeting all of the criteria outlined above. However, no study included in the review met all quality criteria or was defined as high quality. Therefore, studies meeting the following four key criteria were considered “moderately high quality”: (1) own - and cross-PEs calculated from a complete food demand system including at least eight food groups and 70% of all possible food categories (models were still considered complete if only missing restaurant and/or take-away foods); (2) long-run input data with sufficient variation in price used to estimate PEs, i.e., data collected continuously across the survey population, or at least monthly for at least 2 y; (3) own country consumption, prevalence, and mortality data used to populate epidemiological model; (4) large sample (population-based; n≥1,000).

Within objectives 1 and 2, studies were disaggregated by type of pricing policy (tax, subsidy, or combination). Where there were three or more studies within each major category that were sufficiently alike in terms of pricing strategy and outcome, findings were quantitatively pooled to produce a mean PE estimate. Pooled estimates were calculated in two ways, as studies may have assessed more than one tax or subsidy rate. First, all unique tax/subsidy rates and corresponding impacts on consumption were included, thus studies could contribute more than one value. Second, in order to test the effect of correlation of values from the same study, we created a summary mean for each study from the contributing values for that study, and the robustness of the first analysis was assessed. A tax pass-through rate of one (that is, a one-dollar change in tax leads to a dollar change in food price, in the same direction) was assumed. Findings from all other studies were combined in narrative summary.

Ethics Statement

An ethics review was not required for this work.

Results

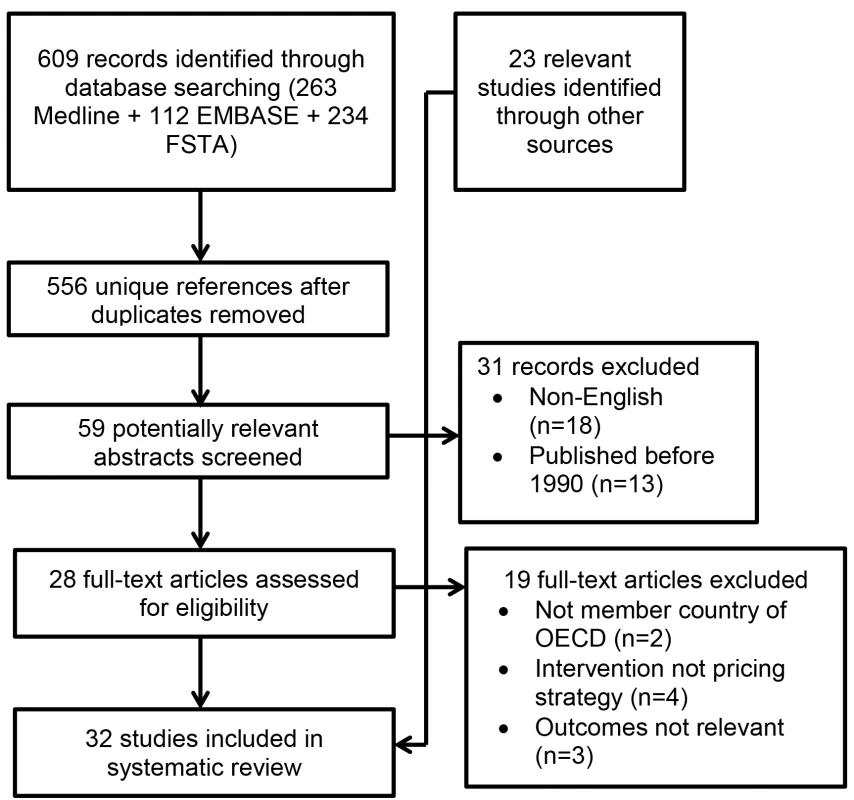

The study selection process is shown in Figure 1. The structured literature search identified 556 potentially relevant unique citations. Of these, 59 potentially relevant abstracts were screened: 31 records were excluded; 18 were published in languages other than English, and the remaining 13 were published prior to 1990. The titles of the non-English articles were available for review in English and were thus reviewed for suitability; all 18 were judged to be outside the scope of the review. Twenty-eight full-text papers were screened for eligibility, of which nine met inclusion criteria for the review. Figure 1 lists reasons for exclusion of the remaining 19 manuscripts. Two articles were excluded because they were from non-OECD countries (both were from Egypt [27],[28]). The first evaluated the effect of the Egyptian food subsidy programme on mother's BMI status. This programme provides all households with a price reduction on bread and flour (57%), and low-income households with price reductions on sugar and cooking oil (43% to 62%, depending on income level) [27]. Seven-day diet recall data from the 1997 Egyptian Integrated Household Survey (n = 2,000 rural and urban households) were linked with pricing information to determine own - and cross-PEs for energy-dense and energy-dilute food. Mother's BMI (from the 1997 Egyptian Integrated Household Survey) was found to be positively associated with lower priced, energy-dense food. However, there was no association between income and BMI. The second study evaluated a reform of the subsidy programme, but did not include any of the outcomes specified for inclusion in this review. Eighteen additional eligible papers and reports were identified through Google Web, Google Scholar, and the bibliographies of included studies. Five further eligible papers and reports were identified through key experts. Thirty-two studies (19 peer-reviewed papers and 13 other types of reports) met all inclusion/exclusion criteria and were included in the review.

Fig. 1. Flow diagram for study selection.

FSTA, Food Science and Technology Abstracts. Fig. 2. Causal diagram for simulation model illustrating how food price leads to health or disease impact.

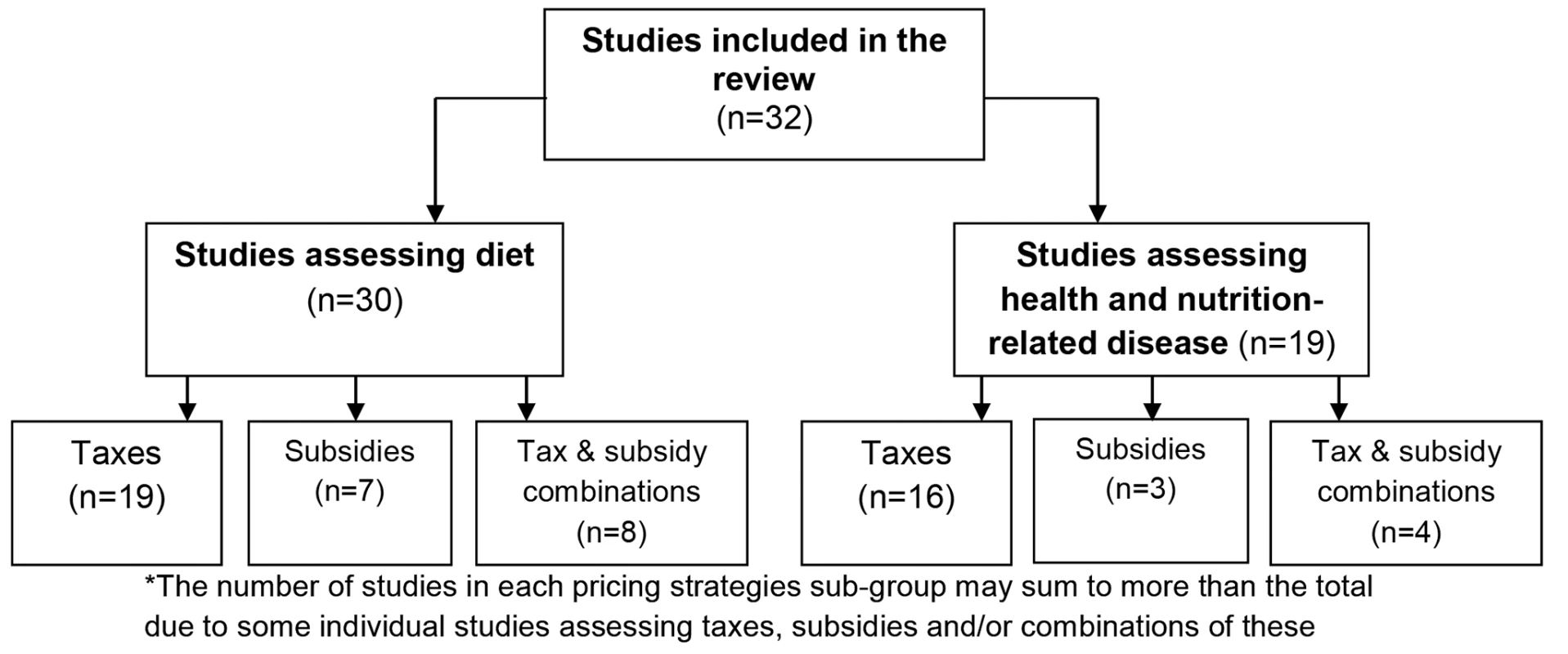

Four steps, or types of variables: food price (A), food intake (B), nutrient and energy intake (C), and the impact on health or disease (D). RRs, relative risks. Figure 3 illustrates the number of studies included in each sub-category for presentation of the review findings (note that some studies have been included in more than one sub-category).

Fig. 3. Summary of included studies and presentation of findings of the review*.

Characteristics of Included Studies

A summary of included studies follows. For a detailed description of each study, please refer to Text S2.

Studies assessing diet (food/nutrient intake or purchases)

Thirty simulation modelling studies assessed the impact of food pricing on diet outcomes (i.e., food/nutrient intake or purchases): 17 assessed food taxes [13],[29]–[45], six assessed subsidies [33],[39],[42],[45]–[47], and seven assessed combinations of food taxes and subsidies [8],[39],[40],[42],[45],[48]–[51] (note that six of the 30 individual studies assessed taxes, subsidies, and/or combinations of taxes and subsidies and as such have been included in more than one category above [33],[39],[40],[42],[45],[51]). Thirty-six food and 12 nutrient outcomes were assessed by the 30 studies included in this section of the review.

Studies assessing health and disease outcomes

Nineteen simulation modelling studies assessed the impact of food pricing on health and disease outcomes: 15 assessed taxes [31],[34]–[38],[40],[41],[43],[45],[52]–[56], three assessed subsidies [45],[56],[57], and four assessed combinations of food taxes and subsidies [40],[45],[50],[52] (note that four of the 19 individual studies assessed taxes, subsidies, and/or combinations of taxes and subsidies and as such have been included in more than one category above [40],[45],[52],[56]. Six health and 16 disease outcomes were assessed by the 19 studies included in this section of the review.

Quality of Included Studies

A table summarising the quality of studies, including the inputs used for the models, is included in Text S2. For the PE quality component, 15/32 studies used a complete demand system, 24/32 studies used what should be long-run PEs, 22/32 included own - and cross-PEs, 11/32 used valid and appropriate source data for PEs, and one study addressed the uncertainty of PE values with probabilistic sensitivity analyses. For the epidemiological component, 30/32 studies used valid and appropriate source data, 25/32 used consumption data that was collected/projected over time, 7/32 undertook some type of sensitivity analyses, and no studies validated or calibrated their model (Table 1).

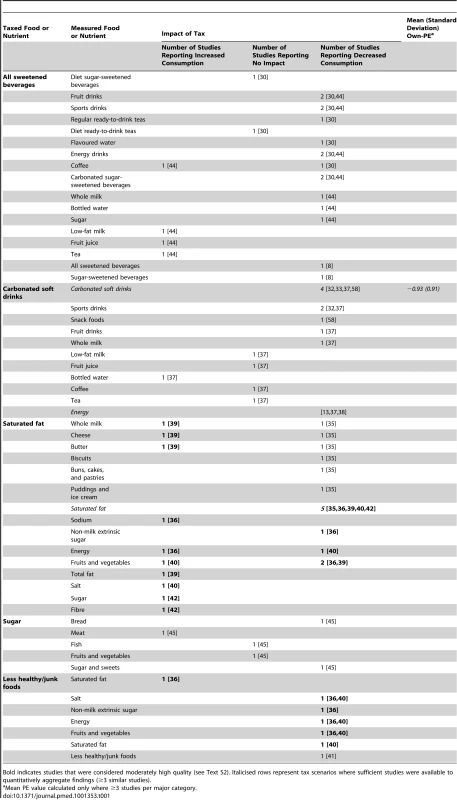

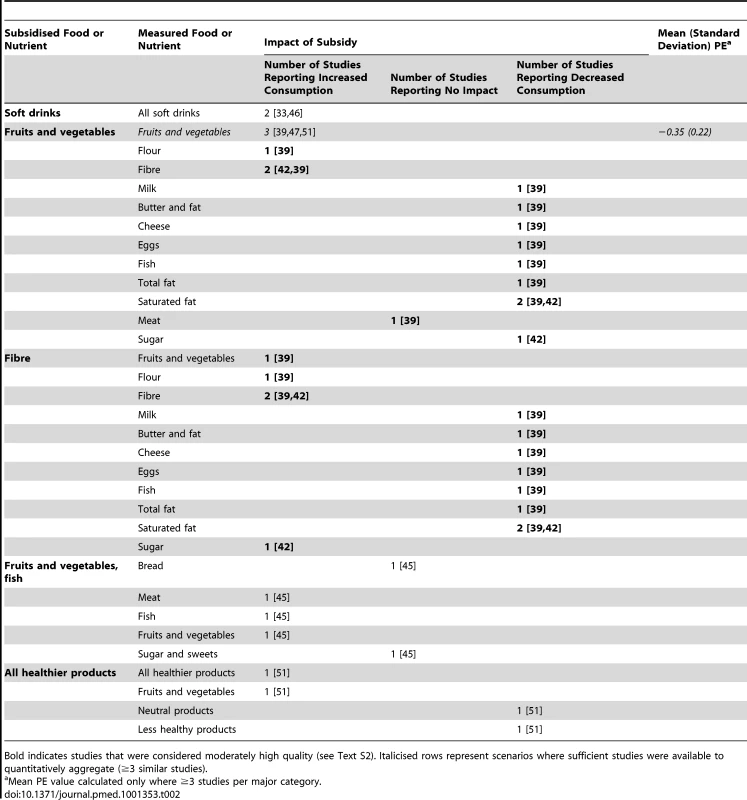

Tab. 1. Summary of simulation modelling studies assessing the impact of taxes on food/nutrient consumption (n = 19 studies).

Bold indicates studies that were considered moderately high quality (see Text S2). Italicised rows represent tax scenarios where sufficient studies were available to quantitatively aggregate findings (≥3 similar studies). Based on our conservative quality criteria, only seven studies were considered “moderately high quality” [29],[36],[39],[40],[42],[52],[55]. Three of these studies were essentially evolutionary studies undertaken by the same/similar group of researchers [36],[40],[52].

A summary of the overall findings of the review is provided in Box 1.

Box 1. Summary of Key Findings

-

Impact on food and nutrient consumption (objective 1): Quantitative summary was possible for three scenarios, all of which suggested impacts on consumption would be pro-health.

-

The own-PE for carbonated soft drinks was −0.93 (range, −0.06, −2.43), and the resulting modelled reduction in energy consumption was −0.02% (range, −0.01%, −0.04%) for each 1% increase in price.

-

The modelled reduction in saturated fat resulting from a saturated fat tax was −0.02% (range, −0.01%, −0.04%) of total energy for each 1% increase in price.

-

The own-PE for a subsidies on fruits and vegetables was −0.35 (range, −0.21, −0.77).

-

-

Impact on health and disease (objective 2) and differences by socio-economic group (objective 3): Variability of food taxes and subsidies and types of consumption, health, and disease outcomes assessed prevented any pooled analyses. However, a few conclusions are possible.

-

Higher quality studies estimated that dairy/saturated fat taxes may increase mortality from CVD and CHD (n = 1 study), and less healthy/junk food taxes may increase overall mortality (n = 1 study) and mortality from stroke and CVD (n = 2 studies).

-

Most (11/14) studies assessing absolute impacts for lower socio-economic groups estimated that effects on food and nutrient consumption, and health and disease, would be pro-health. Relative impacts may also be greater for lower income groups, and thus food taxes and subsidies have the potential to be pro-equity.

-

-

Other key findings:

-

The majority of included studies (25/32) were of low quality. Furthermore, there was substantial variability in model structures, data inputs, and the types and magnitudes of food taxes and subsidies assessed.

-

There was also some evidence that pricing strategies may result in unintended compensatory buying through cross-PEs; two moderately high quality studies estimated a potential increase in consumption of sodium in response to a saturated fat tax, and a potential increase in mortality from CVD in response to a tax on less healthy foods.

-

Objective 1: Estimated Impact on Food and Nutrient Consumption

Taxes

A summary of the findings of the 19 simulation modelling studies included in the review that assessed the impact of taxes on diet is outlined in Table 1. The layout of Table 1 allows assessment of the impact of a tax on a given food on that food itself (own-PE) and other foods not actually taxed (cross-PE). The following types of taxes were assessed: (1) sweetened beverages (n = 4 [8],[30],[43],[44]), (2) carbonated soft drinks (n = 5 [32],[33],[37],[38],[58]), (3) saturated fat (n = 5 [35],[36],[39],[40],[42]), (4) sugar (n = 1 [45]), and (5) less healthy/junk foods (n = 3 [36],[40],[41]).

There was substantial variability in outcomes assessed by the 19 studies (Table 1). However, three or more studies assessed the impact of a carbonated soft drink tax on the same food or nutrient outcome (n = 4 for carbonated soft drink purchases and n = 3 for energy [calories]). In addition, five studies assessed the impact of a saturated fat tax on saturated fat consumption (italicised in Table 1). Overall findings were pro-health, with the majority of studies in each category estimating lowered consumption of the taxed food.

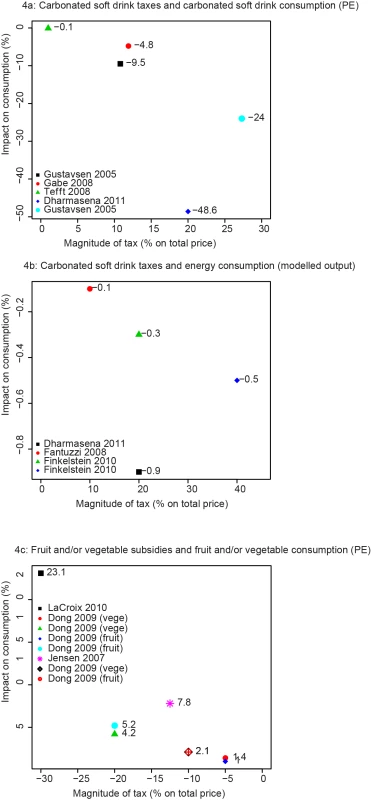

The estimated mean own-PE, which represents the change in demand with a 1% change in price, for carbonated soft drinks was −0.93 (range, −0.06, −2.43) (Figure 4A). The corresponding modelled reduction in the amount of energy (calories) purchased resulting from a carbonated soft drink tax was −0.02% (range, −0.01%, −0.04%) for each 1% increase in price. Figure 4A illustrates that the relationship between carbonated soft drink taxes and reductions in consumption of carbonated soft drinks appears linear. Sensitivity analyses to explore the effect of studies contributing more than one PE value to the overall mean did not substantially change the own-PE for carbonated soft drinks (mean PE for sensitivity analysis, −0.94 [range, −0.06, −2.43]), but almost halved the modelled reduction in energy consumption (−0.014% [range, −0.01, −0.04%]). However, none of these studies were assessed as moderately high quality.

Fig. 4. Relationships between fiscal pricing strategies and change in food consumption.

(A) Carbonated soft drink taxes and carbonated soft drink consumption. (B) Carbonated soft drink taxes and energy consumption. (C) Fruit/vegetable subsidies and fruit/vegetable consumption. Only three of the five studies assessing the impact of a saturated fat tax on saturated fat consumption could be combined. This was due to differences in the format of taxes: three studies assessed flat rate taxes on major dietary contributors to saturated fat [35],[36],[40], and the remaining two studies assessed nutrient taxes per kilogram of saturated fat [39],[42]. For the three studies assessing a flat rate tax, the mean modelled reduction in saturated fat consumption in response to a 1% increase in price was −0.02% (range, −0.01%, −0.04%) energy from saturated fat (findings for one study [40] were converted from percentage reduction in saturated fat to percentage reduction in total energy from saturated fat assuming 12.8% energy consumed from saturated fat in the British population [59]). No studies contributed more than one value to the overall mean impact. In comparison, the two studies assessing nutrient taxes estimated slightly greater reductions of −1.11% and −1.35% of energy from saturated fat resulting from taxes of 14 and 7.9 Danish Krone per kilogram of saturated fat, respectively (€1.88/US$2.33 and €1.06/US$1.31, respectively). Four studies in this section were considered moderately high quality [36],[39],[40],[42]; removal of the lower quality study from the former pooled figure increased the mean reduction in saturated fat to −0.03% (range, −0.02%, −0.04%) energy from saturated fat. There was some evidence from three of the moderately high quality studies of unintended compensatory purchasing that could mitigate the potential health impacts of food taxes (because of a combination of change in expenditure budget and cross-PEs; Table 1). Specifically, saturated fat taxes were estimated to increase consumption of sodium (n = 2 studies [36],[40]), energy (n = 1 study [36]), and sugar (n = 1 study [42]), and a tax on less healthy foods was estimated to increase consumption of saturated fat [36].

There were too few studies to estimate the pooled impact of any other tax scenarios on consumption of foods or nutrients.

Subsidies

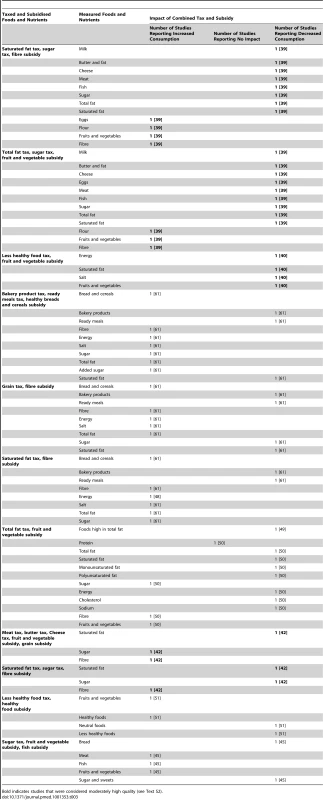

Seven studies estimated the impact of five subsidies, as outlined in Table 2: (1) all soft drinks (n = 2 [33],[46]), (2) fruits and vegetables (n = 2 [39],[47]), (3) fruits and vegetables and fish (n = 1 [45]), (4) fibre (n = 1 [39]), and (5) all healthier products (n = 1 [51]).

Tab. 2. Summary of simulation modelling studies assessing the effects of subsidies on food/nutrient consumption (n = 7 studies).

Bold indicates studies that were considered moderately high quality (see Text S2). Italicised rows represent scenarios where sufficient studies were available to quantitatively aggregate (≥3 similar studies). There was substantial variability in outcomes assessed by the seven simulation studies in this category (Table 2). However, three studies assessed the impact of eight fruit and vegetable subsidies of varying magnitude on consumption of fruits and vegetables (italicised in Table 2). One study was considered moderately high quality [39]; the finding of this study was consistent with that of the lower quality studies, i.e., overall findings were pro-health and the estimated mean own-PE was −0.35 (range, −0.21, −0.77). The standard way of presenting PEs is to present the percentage reduction in consumption that would be expected with each 1% price increase. However, in modelling a subsidy on fruits and vegetables, price will decrease, and thus purchases will likely increase, i.e., in this case a 0.35% increase in fruit and vegetable purchases for each 1% reduction in price. Figure 4B illustrates that the relationship between the magnitude of the fruit and vegetable subsidy and the increase in consumption of fruits and vegetables appears linear. Sensitivity analyses to explore the effect of studies contributing more than one PE value to the overall mean increased the own-PE (mean sensitivity PE, −0.54 [range, −0.23, −0.77]).

There were too few studies to determine the pooled impact of any other food subsidies on foods or nutrients. However, two moderately high quality studies provide some evidence that a subsidy on foods high in fibre decreases consumption of saturated fat [39],[42] (Table 2). There was also some suggestion of unintended compensatory purchasing, with one moderately high quality study indicating that a fruit and vegetable subsidy may result in decreased fish consumption, and a fibre subsidy in decreased fish and increased sugar consumption [39].

Tax and subsidy combinations

The eight simulation modelling studies that assessed the impact of combinations of food taxes and subsidies on food and nutrient consumption evaluated ten different combinations of taxes and subsidies, as outlined in Table 3.

Tab. 3. Summary of simulation modelling studies assessing the impact of tax and subsidy combinations on food and nutrient consumption (n = 8 studies).

Bold indicates studies that were considered moderately high quality (see Text S2). Most of the tax and subsidy combinations examined included a total fat and/or saturated fat tax and a fibre/grain and/or fruit and vegetable subsidy (Table 3). There was substantial variation in the outcomes assessed for each tax and subsidy combination, and thus it was not possible to pool the findings of studies to determine potential impacts on food and nutrient consumption. However, the two moderately high quality studies included in this section of the review support tax and subsidy combinations as being pro-health: Nnoaham and colleagues estimated that a less healthy food tax combined with a fruit and vegetable subsidy would decrease purchases of energy, saturated fat, and sodium [40], and Smed and colleagues reported that a saturated fat and sugar tax combined with a fibre subsidy decreased purchases of saturated fat and sugar while increasing fibre purchases [42] (Table 3). However, Smed et al. [42] estimated that some unintended compensatory buying would occur, with the less healthy food tax and fruit and vegetable subsidy combination resulting in an overall decrease in fruit and vegetable purchases.

Objective 2: Impact on Health and NCDs

Taxes

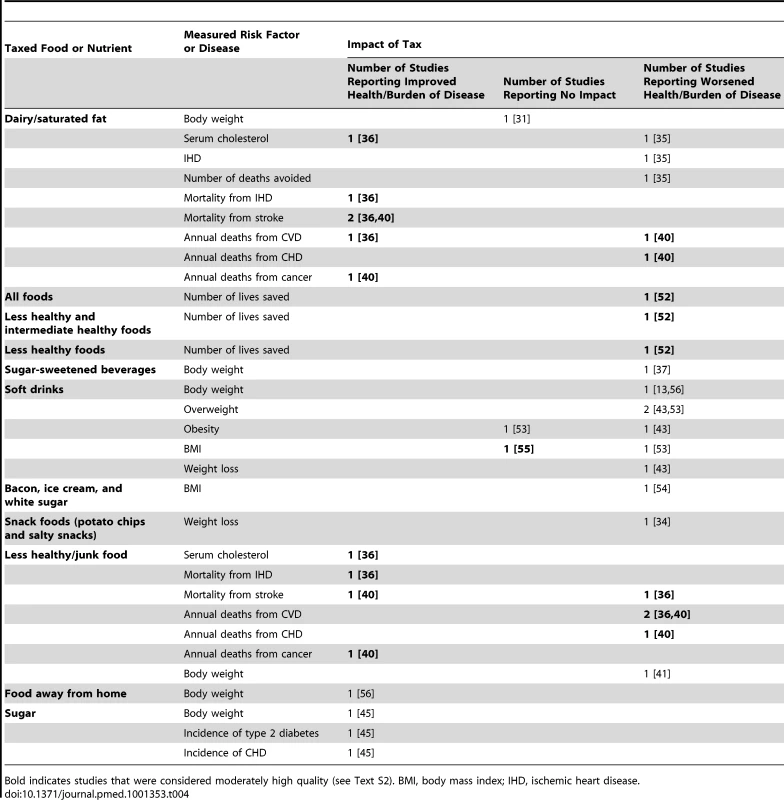

The 16 simulation modelling studies that assessed the impact of food taxes on health and disease evaluated ten types of taxes, as outlined in Table 4.

Tab. 4. Summary of simulation modelling studies assessing the impact of taxes on health/disease (n = 16 studies).

Bold indicates studies that were considered moderately high quality (see Text S2). BMI, body mass index; IHD, ischemic heart disease. There was substantial variation in the outcomes assessed for each type of tax, and thus it was not possible to pool the findings of studies to determine potential impacts on health and disease. Despite the majority of studies in this section of the review suggesting that impacts of food/nutrient taxes would be pro-health, there were also a number of modelling studies that estimated that taxes may affect health outcomes adversely, particularly taxes focusing on dairy/saturated fat and junk food (Table 4). The three moderately high quality studies in this section estimated that (1) a dairy/saturated fat tax may increase mortality from CVD and coronary heart disease (CHD) (n = 1 study [40]), and (2) a less healthy/junk food tax may increase overall mortality (n = 1 study [60]) and mortality from stroke and CVD (n = 2 studies [36],[40]). The potential adverse health consequences estimated as a response to these taxes is due to compensatory purchasing via cross-PEs. For example, in the case of a tax on dairy/saturated fat, the increase in price may reduce purchases of dairy/saturated fat through the own-PE. However, compensatory purchasing may occur that undermines the intention of the tax. In this case, purchases of food substitutes for dairy/saturated fat may increase (via cross-PEs). If these foods are just as unhealthy as the taxed food, or even more so, the result is that the diet is not improved, or in some circumstances may even be worse. For example, bread may be seen as suitable substitute for yoghurt (dairy) as a snack, but if the bread chosen is high in salt, then risk of CVD may inadvertently increase.

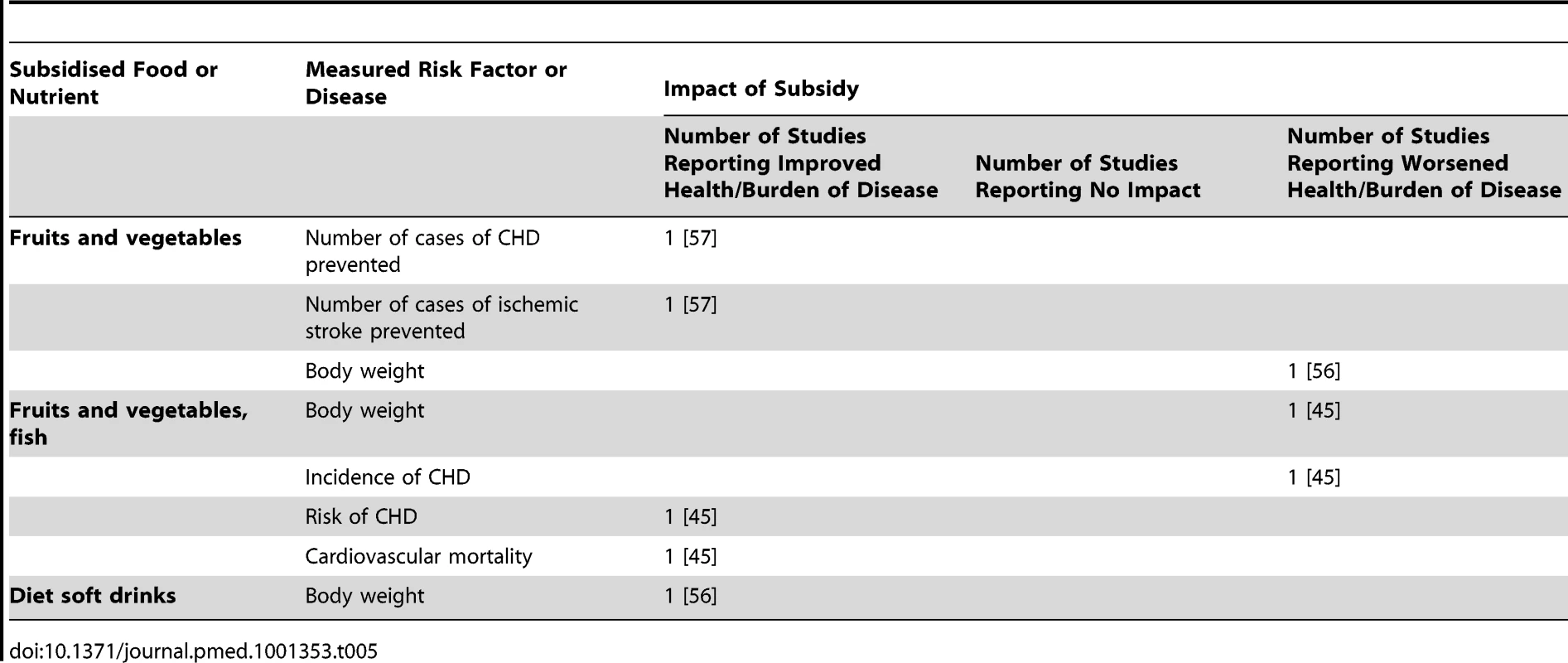

Subsidies

Three simulation modelling studies estimated the impact of food subsidies on health and disease [45],[56],[57]. These studies assessed subsidies on (1) fruits and vegetables (n = 2 [57]), (2) fruits and vegetables and fish (n = 1 [45]), and (3) diet soft drinks (n = 1 [56]).

Although the majority of these modelling studies estimated that food subsidies would improve health and reduce NCDs, there were too few studies (and no moderately high quality studies) to pool the findings for any subsidy regimens or disease outcomes (Table 5).

Tab. 5. Summary of simulation modelling studies assessing the impact of subsidies on health/disease (<i>n</i> = 3 studies).

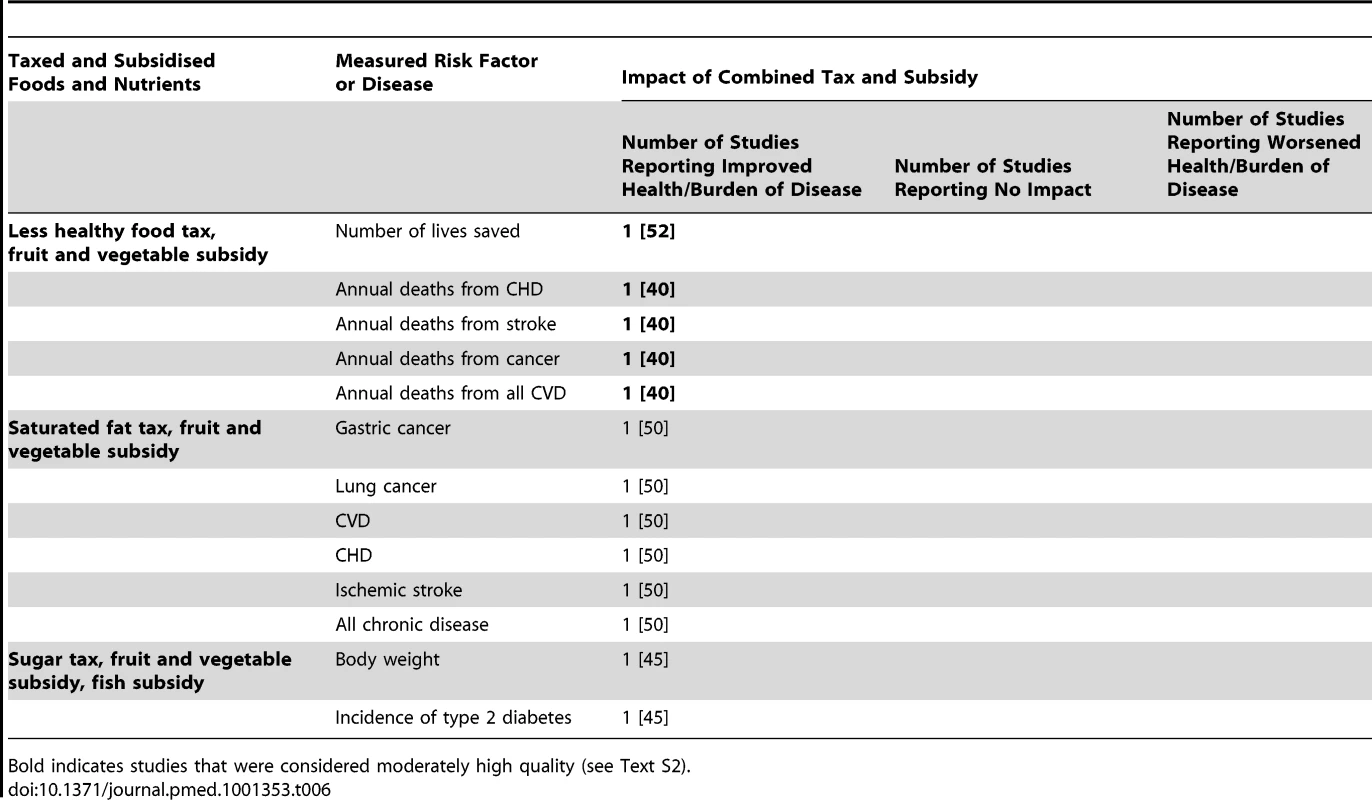

Tax and subsidy combinations

The four modelling studies assessing the impact of food tax and subsidy combinations on health and disease evaluated three combinations of taxes and subsidies, as summarised in Table 6: (1) a less healthy food tax combined with a fruit and vegetable subsidy (n = 2 [40],[52]), (2) a saturated fat tax combine with a fruit and vegetable subsidy (n = 1 [50]), and (3) a sugar tax combined with a fruit and vegetable and fish subsidy (n = 1 [45]).

Tab. 6. Summary of simulation modelling studies assessing the impact of tax and subsidy combinations on health/disease (n = 3 studies).

Bold indicates studies that were considered moderately high quality (see Text S2). Although all of the modelling studies in this category of the review estimated effects to be pro-health (regardless of the outcome measured), the evidence was too limited to evaluate the pooled impact of any tax and subsidy combination on any health or disease outcome (Table 6). Nonetheless, two of the three studies in this section were moderately high quality and estimated positive impacts of a tax on less healthy foods combined with a fruit and vegetable subsidy (i.e., fewer overall premature deaths, and fewer premature deaths from CVD, CHD, stroke, and cancer) [40],[52]. No moderately high quality studies provided any evidence of unintended impacts on health.

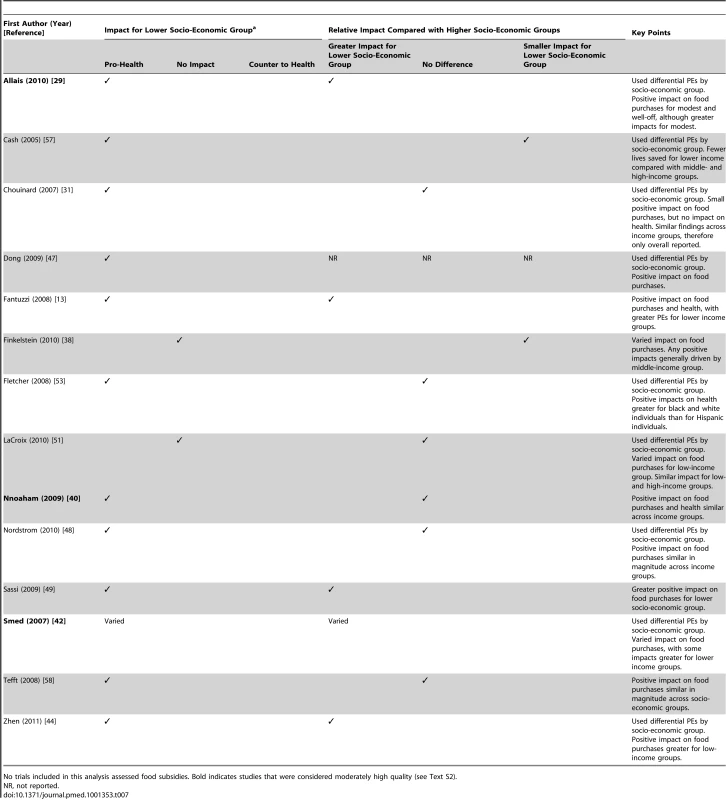

Objective 3: Differences in Impact by Socio-Economic Group

Of the 32 simulation modelling studies included in the review, nine specifically reported differential PEs by socio-economic group [29],[31],[42],[44],[47],[48],[51],[53],[57], and a further five [13],[38], undertook regression or sensitivity analyses to estimate impact of food taxes and subsidies separately by socio-economic position. The findings of these 14 studies are summarised in Table 7.

Tab. 7. Summary of simulation modelling studies assessing the impact of taxes on food and nutrient consumption, health, and disease of lower socio-economic population groups (n = 14 studies).

No trials included in this analysis assessed food subsidies. Bold indicates studies that were considered moderately high quality (see Text S2). Overall, pricing policies appeared to result in improved food and nutrient consumption and health benefits for lower socio-economic groups. This finding was supported by 11/14 studies, including one moderately high quality study [40]. However, many noted that such taxes would be regressive, with the financial burden falling predominantly on the lowest income groups, in which individuals spend the largest proportion of their total budget on food [29],[31],[44]. Nonetheless, 4/14 studies estimated that pricing policies would result in greater health benefits for lower socio-economic compared with higher socio-economic groups, and thus have the potential to reduce health inequalities [13],[29],[44],[49]. Half of the studies in this section estimated that relative impacts would be similar across socio-economic groups (including two moderately high quality studies), which, given that lower socio-economic groups usually have higher NCD burden, translates into a greater absolute impact in lower socio-economic groups. For example, if the relative reduction in CVD is the same for higher and lower income groups (e.g., 10% in each group), but the prevalence of CVD in the lower income group is higher (e.g., 40% compared with 20% for those with higher incomes), the lower income group will stand to receive a greater absolute reduction in CVD (0.1×40% = 4% for the lower income group versus 0.1×20% = 2% for the higher income group). The remaining three studies estimated poorer health outcomes for lower socio-economic groups [38],[42],[57] (one study did not report differences in magnitude by socio-economic group [47]). Findings for the two moderately high quality studies were mixed, with one estimating improved dietary and health outcomes (but no relative differences in impact across socio-economic groups) [40], and the other estimating varied impacts on dietary and health outcomes (with some relative differences by socio-economic group) [42].

Discussion

Notwithstanding the low to moderate quality of the majority (27/32) of the included studies, the overall finding of this review is that pricing strategies have the potential to produce changes in population food consumption. A summary of key findings is provided in Box 1.

This review carefully examined the quality of simulation models, and only 22% (7/32) of included studies were considered moderately high quality. Less than half (13/32) of included studies used a complete food demand system encompassing both own - and cross-PEs. The lack of inclusion of cross-PEs in particular may have affected the results of this review. For example, if less healthy foods are relatively price-inelastic (i.e., increases in price do not greatly influence amounts purchased of the targeted food items), then the remaining budget available to spend on other foods is smaller, and, because of the balance of cross-PEs, purchasing shifts away from healthier foods such as fruits and vegetables to poorer quality foods high in saturated fat and sodium. If a larger number of studies had included cross-PEs, it may have been possible to quantitatively assess these unintended effects. Indeed, we would recommend that simulation studies that include only own-PEs be treated with caution.

Nonetheless, a particular aim of this review was to collate and quantitatively summarise the best evidence from simulation modelling studies regarding the association between food pricing strategies, food consumption, health, and NCDs. Therefore, although the pooled estimates are based on lower quality studies, the estimates can be improved upon as more relevant, higher quality research becomes available. Plotting the estimated impact on consumption resulting from food taxes and subsidies of various magnitudes (Figure 4) produces a linear trend, suggesting that, to a point, overall, the larger the magnitude of the tax or subsidy, the larger the impact on consumption (in the desired direction). Figure 4's scatter plots effectively illustrate the mean PE. As more evidence becomes available, more points could be added to these scatter plots to help to determine the potential shape of the PE curve.

An updated literature search to October 2012 identified three additional studies meeting the inclusion criteria for this review [62]–[64]. All three focussed on sugar-sweetened beverages, with two exploring the impact of taxes [63],[64], and one the impact of a tax reform [62]. Consistent with previous research, these studies failed to assess impacts on the complete food demand system, although all took into account compensatory purchasing of other types of beverages via cross-PEs. Because of the variability in the metrics used by these studies to tax soft drinks and assess the outcomes, it was not possible to add these studies to the scatter plots illustrating the PE curve. However, the results of these newer studies align with those of similar studies included in the review [8],[45]: a penny-per-ounce sugar-sweetened beverage tax in the United States was estimated to reduce purchases of these beverages by 15% in adults and prevent 26,000 premature deaths between 2010 and 2020 [64], a 39% sugar-sweetened beverage tax in the United States was estimated to decrease sugar purchases by 10% [63], and a reform of the European Union sugar policy in France to effectively decrease the price of regular soft drinks by 3% was estimated to raise purchases of these drinks by 1 litre per person per year [62].

The majority of studies in this review failed to take into account that own - and cross-PEs are difficult to calculate accurately and precisely and thus that error/variation must be taken into account in the modelling process (error and appropriate reflection of uncertainty is important in modelling). Reporting of statistical variance around a point estimate, and discussion of any suspected systematic errors would provide some idea of the uncertainty of the own - and cross-PEs (and hence uncertainty of the overall findings of the simulation model). Furthermore, no studies included in the review attempted to validate the epidemiological model used to estimate impacts on consumption, health, and disease. Validation is important because underlying model structure and assumptions vary widely between models and are associated with uncertainty; without validation or comparison of findings with other models, it is difficult to determine whether findings are real, or in fact artefacts of the model itself.

Most studies in this review (25/32; 78%) failed to estimate the uncertainty of model findings. Uncertainty arises from the model structure and variation in the model inputs, including food consumption data, food prices, relative risks, and PEs. Uncertainty arising from the model structure is more difficult to estimate, but uncertainty arising from inputs may be dealt with using Monte Carlo simulations [65]. In summary, the quality of future simulation modelling studies could be vastly improved by (1) using a complete demand system including own - and cross-PEs, (2) estimating the uncertainty around model outputs, and (3) attempting to validate epidemiological models. The impact of ten key quality indicators for simulation models is further discussed in Text S2.

Another limitation of this review is that it is possible that publication bias is present. Such bias is common in systematic reviews and is often assessed using a funnel plot [66]. However, the studies in this review were not randomised controlled trials, the pricing strategies and outcomes were highly variable, and most studies failed to report variability around the point estimate. Therefore, it was not possible to create a funnel plot. Bias may also have been introduced via the search strategy, which was limited to articles and reports published in English and conducted in member countries of the OECD [67]. Nonetheless, the titles of all non-English-language studies were available in English and were thus reviewed; none were likely to meet the inclusion criteria for this review. Further, a number of the included studies were from countries where English is not the primary language, i.e., France (n = 2), Norway (n = 1), Denmark (n = 2), Finland (n = 1), and Sweden (n = 1), and thus any impact of this potential bias on study findings is likely to have been minimal. With respect to the exclusion of non-OECD countries, only two studies, both from Egypt, were excluded. Furthermore, one of these studies did not assess any of the outcomes pre-specified for this review [28], and the other assessed a food subsidy programme that aimed to reduce under - rather than over-nutrition [27]. Nonetheless, it is notable that included studies were from middle - to high-income countries, and thus the findings of this review may not be generalisable to low-income countries.

The findings of this review support those of a previous systematic review undertaken by Thow and colleagues (n = 16 simulation modelling studies to 2009) [20]. However, the findings of the current review indicate smaller changes in diet, health, and disease resulting from food taxes and subsidies compared with those suggested by Thow et al. This is likely due to many studies in the earlier review failing to take into account shifts in consumption of non-targeted foods (using cross-PEs). Inclusion of cross-PEs enables assessment of unintended compensatory or displacement purchasing that can undermine the health objective of the tax or subsidy. Larger cross-PEs indicate that non-targeted foods are suitable substitutes for targeted/taxed/subsidised foods, and thus larger cross-PEs mean a higher likelihood of compensatory purchasing. If such purchasing involves a less healthy dietary replacement, then it is likely to produce effects that are counter to health. For example, in the moderately high quality study by Mytton et al. [36], authors assessed the impact of a 17.5% tax on principal sources of saturated fat in the British diet. The tax was estimated to reduce percentage energy consumed from saturated fat (by −0.13%), but through unintended compensatory purchasing, salt intake was also estimated to increase by 5.3%. However, if compensatory purchasing involves a healthier replacement, then large positive impacts on health are likely to be observed. The impacts of compensatory purchasing are of particular importance for lower income households, where both own - and cross-PEs are commonly larger than for households with higher income [13],[68].

Fourteen studies in this review evaluated the potential impacts of pricing strategies for lower socio-economic population sub-groups, which are most at risk of having poor dietary intakes and NCDs. The majority of these studies (11/14) estimated that fiscal policies would result in absolute improvements in dietary outcomes for lower socio-economic groups, although only four studies estimated relatively greater health benefits for lower compared with higher socio-economic groups, and thus improved health equity. Findings for the two moderately high quality studies were mixed, and several authors noted that taxes would be regressive. Whether taxes, subsidies, or combinations of both result in greater dietary and health improvements in lower compared with higher socio-economic groups is important to consider. If PEs are greater among low-income population sub-groups, then negative financial implications will be at least partially offset by greater improvements to health and an overall effect of decreasing health inequities (as has been observed for tobacco taxes [69]). Furthermore, overall health benefits for lower socio-economic groups may be greater if food taxes are combined with other fiscal policies to counterbalance increased food costs (such as lower income tax for low-income earners and increases in welfare benefits).

Although food pricing strategies show promise for improving population health, this review highlights several important areas for future research. First, the association of pricing strategies with non-targeted food consumption must be evaluated through inclusion of cross-PEs that are appropriate and valid for the population being investigated. This would be particularly valuable with respect to soft drink and saturated fat taxes, and fruit and vegetable subsidies. Second, effects of food pricing strategies must be assessed for lower socio-economic population groups, which are most at risk of NCDs, particularly in countries where there are large health inequalities. Third, long-term health and NCD mortality must be assessed. The cost-effectiveness of food pricing strategies is also particularly important to investigate if such strategies are to be considered feasible for implementation. Moreover, there are many pragmatic issues that need to be addressed by future research. These include whether it is best to apply taxes/subsidies at the point of sale or point of production (i.e., sales or excise taxes), which magnitude and combination of taxes and/or subsidies will be most effective, whether price changes should be applied at a flat rate (e.g., increasing the price of butter at the point of sale) or at a rate per nutrient/volume of food (e.g., increasing the price of butter by an amount per gram of saturated fat) [12],[20], and the percentage of tax or subsidy that reaches the consumer (tax pass through). Given the limitations of the current evidence, robust evaluations must be planned when food pricing policies are implemented by governments.

It must be noted that the impact of any given food tax or subsidy is likely to differ by country (i.e., heterogeneity of impact by context), depending on factors such as the type of tax system implemented, health status, co-existent marketing, cultural norms, expendable income, and the social role of food [70]. Unfortunately, the use of different types of datasets and epidemiological models by authors of papers in this review meant that it was not possible to compare the potential effects of specific food pricing strategies by population or country of interest. Furthermore, evidence for low-income countries is largely absent. While we currently have far too few studies to assess how much impacts vary by context, we must expect that they will and evaluate future research in that light.

The best evidence for the effectiveness of food pricing strategies may be the results of “natural experiments”. Differential application of goods and services tax or value added tax currently occurs in several countries, including Australia, Canada, France, and the United Kingdom. However, the primary purpose of these differential taxes is not to promote health. Nonetheless, four such natural experiments were evaluated in the current review, one of which was undertaken in Ireland [46], and three in the United States [8],[32],[55]; all focused on soft drinks or sugar-sweetened beverages. Three of these studies assessed effects on food or nutrient consumption, and all three studies reported impacts in the desired direction [8],[32],[46] (two assessed effects on health: one found no impact [55] and the other found a positive impact [8]). Several countries currently have differential health-related food taxes [71]. Most recently (2011 or 2012), Denmark implemented a €2.41 levy per kilogram of saturated fat (for products ≥2.3% saturated fat; the tax increases with amount of saturated fat), France applied a €0.036 per litre tax on sweetened beverages [72], and Hungary introduced a 10-forint tax (€0.04) per item on foods high in total fat, sugar, and salt [73]. However, no evaluation of the impact of these taxes on food purchases and health has yet been published.

In conclusion, this review systematically summarises the best evidence available to date on the association between food pricing strategies, food consumption, health, and NCDs. We make recommendations regarding better design, assessment of quality, and reporting of future simulation studies. Furthermore, we present pooled estimates of effect. The current evidence suggests food pricing strategies show potential for changing population diets and long-term health and disease outcomes; quantitative analyses indicate own-PEs of demand for carbonated soft drinks and fruits and vegetables, which are reasonably elastic on a population scale (−0.93 [range, −0.06, −2.43] and −0.35 [range, −0.21, −0.77], respectively), and a modelled −0.02% reduction (range, −0.01%, −0.04%) in energy from saturated fat for each 1% price increase. Based on these PE estimates, a 10% increase in the price of soft drinks could decrease consumption by −0.6% to −24.3%; conversely, a 10% decrease in the price of fruits and vegetables could increase consumption by between 2.1% to 7.7%. Nonetheless, high-quality evidence is lacking, particularly with regard to the unintended effects of compensatory purchasing and the potential impacts on health equity, long-term health, and NCD mortality. Moreover, cost-effectiveness and pragmatic issues associated with the implementation of food pricing strategies must also be addressed. Robust evaluations built into the implementation of food pricing policies would help to answer some of these questions and engender confidence that such strategies will provide positive effects on population diets and reduce the global burden of NCDs.

Supporting Information

Zdroje

1. EzzatiM, LopezAD, RodgersA, Vander HoornS, MurrayCJL (2002) Selected major risk factors and global and regional burden of disease. Lancet 360 : 1347–1360.

2. World Health Organization (2008) Closing the gap in a generation: health equity through action on the social determinants of health. Geneva: World Health Organization. Available: http://whqlibdoc.who.int/publications/2008/9789241563703_eng.pdf. Accessed 25 January 2011.

3. BeagleholeR, BonitaR, HortonR, AdamsC, AlleyneG, et al. (2011) Priority actions for the non-communicable disease crisis. Lancet 377 : 1438–1447.

4. Di CesareM, KhangYK, BlakelyT, CowanM, FarzadfarF, et al. (2012) Inequalitites in non-communicable diseases. Lancet In press.

5. BeagleholeR, BonitaR, AlleyneG, HortonR, LiL, et al. (2011) UN High-Level Meeting on Non-Communicable Diseases: addressing four questions. Lancet 378 : 449–455.

6. GlanzK, BasilM, MaibachE, GoldbergJ, SnyderD (1998) Why Americans eat what they do: taste, nutrition, cost, convenience, and weight control concerns as influences on food consumption. J Am Diet Assoc 98 : 1118–1126.

7. FoneD, HollinghurstS, TempleM, RoundA, LesterN, et al. (2003) Systematic review of the use and value of computer simulation modelling in population health and health care delivery. J Public Health Med 25 : 325–335.

8. Chaloupka FJ, Wang YC, Powell LM, Andreyeva T, Chriqui JF, et al.. (2011) Estimating the potential impact of sugar-sweetened and other beverage excise taxes in Illinois. Oak Forest (Illinois): Cook County Department of Public Health. Available: http://www.cookcountypublichealth.org/files/pdf/Chaloupka_Report_PRF.pdf. Accessed 25 January 2011.

9. WagenaarAC, SaloisMJ, KomroKA (2009) Effects of beverage alcohol price and tax levels on drinking: a meta-analysis of 1003 estimates from 112 studies. Addiction 104 : 179–190.

10. JacobsonMF, BrownellKD (2000) Small taxes on soft drinks and snack foods to promote health. Am J Public Health 90 : 854–857.

11. World Health Organization (2008) 2008–2013 action plan for the global strategy for the prevention and control of non-communicable diseases. Geneva: World Health Organization. Available: http://www.cookcountypublichealth.org/files/pdf/Chaloupka_Report_PRF.pdf. Accessed 25 January 2011.

12. Engelhard CL, Garson A, Dorn S (2009) Reducing obesity: policy strategies from the tobacco wars. Washington (District of Columbia): The Urban Institute. Available: http://www.politiquessociales.net/IMG/pdf/411926_reducing_obesity.pdf. Accessed 19 January 2012.

13. Fantuzzi K (2008) Carbonated soft drink consumption: implications for obesity policy [PhD dissertation]. Storrs (Connecticut): University of Connecticut.

14. HernandezD, ColeB, DeanL, DoveS, AdlerS, et al. (2010) Subsidization of fruits and vegetables in two urban supermarkets leads to increases in purchasing and intakes of these foods, as well as weight loss. Obes Rev 11(Suppl 1): 60.

15. Ni MhurchuC, BlakelyT, JiangY, EylesH, RodgersA (2010) Effects of price discounts and tailored nutrition education on supermarket purchases: a randomized, controlled trial. Am J Clin Nutr 91 : 736–747.

16. BallK, McNaughtonS, MhurchuCN, AndrianopoulosN, InglisV, et al. (2011) Supermarket Healthy Eating for Life (SHELf): protocol of a randomised controlled trial promoting healthy food and beverage consumption through price-reduction and skill-building strategies. BMC Public Health 11 : 715.

17. WaterlanderW Promotion of fruit and vegetable consumption among low-income groups using a pricing strategy. Trial registered on ISRCTN Available: http://www.controlled-trials.com/isrctn/search.html?srch=isrctn56596945&sort=3&dir=desc&max=10&Submit=SUBMIT. Accessed 8 November 2012.

18. HomerJB, HirschSM (2006) System dynamics modeling for public health: background and opportunities. Am J Public Health 96 : 452–458.

19. LevyDT, MabryPL, WangYC, GortmakerS, HuangTT-K, et al. (2010) Simulation models of obesity: a review of the literature and implications for research and policy. Obes Rev 12 : 378–394.

20. ThowAM, JanS, LeederS, SwinburnB (2010) The effect of fiscal policy on diet, obesity and chronic disease: a systematic review. Bull World Health Org 88 : 609–614 doi:10.2471/BLT.2409.070987.

21. CaraherM, CowburnG (2005) Taxing food: implications for public health nutrition. Public Health Nutr 8 : 1242–1249.

22. PowellLM, ChaloupkaFJ (2009) Food prices and obesity: evidence and policy implications for taxes and subsidies. Milbank Q 87 : 229–257.

23. JensenJD, HartmanH, de MulA, SchuitAJ, BrugJ (2011) Economic incentives and nutritional behavior of children in the school setting. Nutr Rev 69 : 660–674.

24. ThowAM, QuestedC, JuventinL, KunR, KhanAN, et al. (2011) Taxing soft drinks in the Pacific: implementation lessons for improving health. Health Promot Int 26 : 55–64.

25. Higgins JPT, Green S (2011) Cochrane handbook for systematic reviews of interventions, version 5.1.0. The Cochrane Collaboration. Available: http://www.cochrane-handbook.org/. Accessed 24 January 2011.

26. Organisation for Economic Co-operation and Development (2012) List of OECD member countries—ratification of the convention on the OECD. Available: http://www.oecd.org/general/listofoecdmembercountries-ratificationoftheconventionontheoecd.htm. Accessed 8 November 2012.

27. AsfawA (2006) Do government food price policies affect the prevalence of obesity? Empirical evidence from Egypt. World Dev 35 : 687–701.

28. RamadanR, ThomasA (2011) Evaluating the impact of reforming the food subsidy program in Egypt: a mixed demand approach. Food Policy 36 : 637–645.

29. AllaisO, BertailP, NicheleV (2010) The effects of a fat tax on French households' purchases: a nutritional approach. Am J Agric Econ 92 : 228–244.

30. AndreyevaT, ChaloupkaFJ, BrownellKD (2011) Estimating the potential of taxes on sugar-sweetened beverages to reduce consumption and generate revenue. Prev Med 52 : 413–416.

31. ChouinardHH, DavisDE, LaFranceJT, PerloffJM (2007) Fat taxes: big money for small change. Forum Health Econ Policy 10: article 2.

32. Gabe T (2008) Fiscal and economic impacts of beverage excise taxes imposed by Maine public law 629. Orono (Maine): University of Maine.

33. Gustavsen G (2005) Public policies and the demand for carbonated soft drinks: a censored quantile regression approach. Copenhagen: European Association of Agricultural Economists.

34. KuchlerF, TegeneA, HarrisJM (2005) Taxing snack foods: manipulating diet quality or financing information programs? Rev Agric Econ 27 : 4–20.

35. MarshallT (2000) Exploring a fiscal food policy: the case of diet and ischemic heart disease. BMJ 320 : 301–305.

36. MyttonO, GrayA, RaynerM, RutterH (2007) Could targeted food taxes improve health? J Epidemiol Community Health 61 : 689–694.

37. DharmasenaS, CappsO (2011) Intended and unintended consequences of a proposed national tax on sugar-sweetended beverages to combat the U.S. obesity problem. Health Econ 21 : 669–694 doi:10.1002/hec.1738.

38. FinkelsteinEA, ZhenC, NonnemakerJ, ToddJE (2010) Impact of targeted beverage taxes on higher - and lower-income households. Arch Intern Med 170 : 2028–2034.

39. JensenJD, SmedS (2007) Cost-effective design of economic instruments in nutrition policy. Int J Behav Nutr Phys Act 4 : 10 doi:10.1186/1479-5868-1184-1110.

40. NnoahamKE, SacksG, RaynerM, MyttonO, GrayA (2009) Modelling income group differences in the health and economic impacts of targeted food taxes and subsidies. Int J Epidemiol 38 : 1324–1333.

41. SacksG, VeermanJL, MoodieM, SwinburnB (2010) ‘Traffic-light’ nutrition labelling and ‘junk-food’ tax: a modelled comparison of cost-effectiveness for obesity prevention. Int J Obes 35 : 1001–1009.

42. SmedS, JensenJ, DenverS (2007) Socio-economic characteristics and the effect of taxation as a healthy policy instrument. Food Policy 32 : 624–639.

43. Smith TA, Lin B-H, Lee J-Y (2010) Taxing caloric sweetened beverages: potential effects on beverage consumption, calorie intake and obesity. Washington (District of Columbia): US Department of Agriculture. Available: http://www.ers.usda.gov/media/138598/err100_1_.pdf. Accessed 2 November 2012.

44. ZhenC, WohlgenantMK, KarnsS, KaufmanP (2011) Habit formation and demand for sugar-sweetened beverages. Am J Agric Econ 93 : 175–193.

45. Kotakorpi K, Harkanen T, Pietinen P, Reinivuo H, Suoniemi I, et al.. (2011) The welfare effects of health-based food tax policy. CESinfo Working Paper Series No. 3633. Available: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1959273. Accessed 25 January 2012.

46. BahlR, BirdR, WalkerMB (2003) The uneasy case against discriminatory excise taxation: soft drink taxes in Ireland. Public Financ Rev 31 : 510–533 doi:10.1177.1091142103253753.

47. Dong D, Lin B-H (2009) Fruit and vegetable consumption by low-income Americans. Washington (District of Columbia): US Department of Agriculture. Available: http://www.ers.usda.gov/media/185375/err70.pdf. Accessed 2 November 2012.

48. NordstromJ, ThunstromL (2010) Can targeted food taxes and subsidies improve the diet? Distributional effects among income groups. Food Policy 36 : 259–271.

49. SassiF, CecchiniM, LauerJ, ChisholmD (2009) Improving lifestyles, tackling obesity: the health and economic impact of prevention strategies. OECD Health Working Papers No. 48 doi:10.1787/220087432153.

50. TiffinR, ArnoultM (2011) The public health impacts of a fat tax. Eur J Clin Nutr 65 : 427–433.

51. LaCroix A, Muller L, Ruffieux B (2010) To what extent would the poorest consumers nutritionally and socially benefit from a global food tax and subsidy reform? A framed field experiment based on daily food intake. Available: http://ideas.repec.org/p/gbl/wpaper/201004.html. Accessed 25 January 2012.

52. Clarke D, Scarborough P, Rayner M (2010) Estimating the effects of different food tax and subsidy scenarios on the health of the population of Jersey. London: University of Oxford.

53. FletcherJM, TefftN (2010) Can soft drink taxes reduce population weight? Cont Econ Policy 28 : 23–35.

54. Gelbach JB, Kilick J, Stratmann T (2007) Cheap donuts and expensive broccoli: the effect of relative prices on obesity. Social Science Research Network. Available: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=976484. Accessed 25 January 2012.

55. Oaks B (2005) An evaluation of the snack tax on the obesity rate of Maine [thesis]. Maine: Department of Political Science, Texas State University. Available: https://digital.library.txstate.edu/bitstream/handle/10877/3670/fulltext.pdf?sequence=1. Accessed 8 November 2012.

56. SchroeterC, LuskJ, TynerW (2008) Determining the impact of food price and income changes on body weight. J Health Econ 27 : 45–68.

57. CashHH, DavisDE, LaFranceJT, PerloffJM (2005) Fat taxes and thin subsidies: prices, diet, and health outcomes. Acta Agr Scand 2 : 167–174.

58. Tefft N (2008) The effects of a soft drink tax on household expenditures. Lewiston (Maine): Bates College. Available: http://abacus.bates.edu/~ntefft/research/soft_drink_taxes_ces.pdf. Accessed 28 January 2012.

59. Department of Health (2011) National Diet and Nutrition Survey: headline results from years 1 and 2 (combined) of the rolling programme 2008/9–2009/10. London: Department of Health. Available: http://www.dh.gov.uk/en/Publicationsandstatistics/Publications/PublicationsStatistics/DH_128166. Accessed 5 July 2012.

60. ClarkeR, FrostC, CollinsR, ApplebyP, PetoR (1997) Dietary lipids and blood cholesterol: quantitative meta-analysis of metabolic ward studies. BMJ 314 : 112–117.

61. NordstromJ, ThunstromL (2009) The impact of tax reforms designed to encourage healthier grain consumption. J Health Econ 28 : 622–634.

62. BonnetC, RequillartV (2011) Does the EU sugar policy reform increase added sugar consumption? An empirical evidence on the soft drink market. Health Econ 20 : 1012–1024.

63. MiaoZ, BeghinJC, JensenHH (2011) Taxing sweets: sweetener input tax or final consumption tax? Contemp Econ Policy 30 : 344–361 doi:10.1111/j.1465-7287.2011.00278.x.

64. WangYC, CoxsonP, ShenYM, GoldmanL, Bibbins-DomingoK (2012) A penny-per-ounce tax on sugar-sweetened beverages would cut health and cost burdens of diabetes. Health Affair 31 : 199–207.

65. Kalos MH, Whitlock PA (2008) Monte Carlo methods. Weinheim: Wiley-VCH.

66. SuttonAJ, DuvalSJ, TweedieRL, AbramsKR, JonesDR (2000) Empirical assessment of effect of publication bias on meta-analyses. Brit Med J 320 : 1574–1577.

67. MoherD, FortinP, JadadAR, JuniP, KlassenT, et al. (1996) Completeness of reporting of trials published in languages other than English: implications for conduction and reporting of systematic reviews. Lancet 347 : 363–366.

68. StrumR, PowellLM, ChriquiJF, ChaloupkaFJ (2010) Soda taxes, soft drink consumption, and children's body mass index. Health Aff 29 : 1052–1058.

69. GospodinovN, IrvineI (2009) Tobacco taxes and regressivity. J Health Econ 28 : 375–384.

70. JouJ, TechakehakijW (2012) International application of sugar-sweetened beverage (SSB) taxation in obesity reduction: factors that may influence policy effectiveness in country-specific contexts. Health Policy 107 : 83–90.

71. MyttonO, ClarkeD, RaynerM (2012) Taxing unhealthy food and drinks to improve health. BMJ 344: e2931 doi: 10.1136/bmj.e2931.

72. VillanuevaT (2011) European nations launch tax attack on unhealthy foods. CMAJ 183: E1229–E1230 doi:10.1503/cmaj.1109–4031.

73. HoltE (2011) Hungary to introduce broad range of fat taxes. Lancet 378 : 755.

Štítky

Interní lékařství

Článek vyšel v časopisePLOS Medicine

Nejčtenější tento týden

2012 Číslo 12- Berberin: přírodní hypolipidemikum se slibnými výsledky

- Léčba bolesti u seniorů

- Příznivý vliv Armolipidu Plus na hladinu cholesterolu a zánětlivé parametry u pacientů s chronickým subklinickým zánětem

- Jak postupovat při výběru betablokátoru − doporučení z kardiologické praxe

- Červená fermentovaná rýže účinně snižuje hladinu LDL cholesterolu jako vhodná alternativa ke statinové terapii

-

Všechny články tohoto čísla

- Effect of Flexible Sigmoidoscopy-Based Screening on Incidence and Mortality of Colorectal Cancer: A Systematic Review and Meta-Analysis of Randomized Controlled Trials

- Addressing Global Disparities in the Burden of Noncommunicable Diseases: Call for Papers

- PRIME: A Programme to Reduce the Treatment Gap for Mental Disorders in Five Low- and Middle-Income Countries

- Preventing Pandemics Via International Development: A Systems Approach

- Personalized Prediction of Lifetime Benefits with Statin Therapy for Asymptomatic Individuals: A Modeling Study

- Food Pricing Strategies, Population Diets, and Non-Communicable Disease: A Systematic Review of Simulation Studies

- Research on Implementation of Interventions in Tuberculosis Control in Low- and Middle-Income Countries: A Systematic Review

- Uptake of Home-Based Voluntary HIV Testing in Sub-Saharan Africa: A Systematic Review and Meta-Analysis

- National, Regional, and Global Trends in Infertility Prevalence Since 1990: A Systematic Analysis of 277 Health Surveys

- Ending Neglect of Older People in the Response to Humanitarian Emergencies

- Progress toward Global Reduction in Under-Five Mortality: A Bootstrap Analysis of Uncertainty in Millennium Development Goal 4 Estimates

- PLOS Medicine

- Archiv čísel

- Aktuální číslo

- Informace o časopisu

Nejčtenější v tomto čísle- Addressing Global Disparities in the Burden of Noncommunicable Diseases: Call for Papers

- Personalized Prediction of Lifetime Benefits with Statin Therapy for Asymptomatic Individuals: A Modeling Study

- Progress toward Global Reduction in Under-Five Mortality: A Bootstrap Analysis of Uncertainty in Millennium Development Goal 4 Estimates

- Effect of Flexible Sigmoidoscopy-Based Screening on Incidence and Mortality of Colorectal Cancer: A Systematic Review and Meta-Analysis of Randomized Controlled Trials

Kurzy

Zvyšte si kvalifikaci online z pohodlí domova

Současné možnosti léčby obezity

nový kurzAutoři: MUDr. Martin Hrubý

Všechny kurzyPřihlášení#ADS_BOTTOM_SCRIPTS#Zapomenuté hesloZadejte e-mailovou adresu, se kterou jste vytvářel(a) účet, budou Vám na ni zaslány informace k nastavení nového hesla.

- Vzdělávání