-

Články

Top novinky

Reklama- Vzdělávání

- Časopisy

Top články

Nové číslo

- Témata

Top novinky

Reklama- Videa

- Podcasty

Nové podcasty

Reklama- Kariéra

Doporučené pozice

Reklama- Praxe

Top novinky

ReklamaTobacco Industry Manipulation of Tobacco Excise and Tobacco Advertising Policies in the Czech Republic: An Analysis of Tobacco Industry Documents

Background:

The Czech Republic has one of the poorest tobacco control records in Europe. This paper examines transnational tobacco companies' (TTCs') efforts to influence policy there, paying particular attention to excise policies, as high taxes are one of the most effective means of reducing tobacco consumption, and tax structures are an important aspect of TTC competitiveness.Methods and Findings:

TTC documents dating from 1989 to 2004/5 were retrieved from the Legacy Tobacco Documents Library website, analysed using a socio-historical approach, and triangulated with key informant interviews and secondary data. The documents demonstrate significant industry influence over tobacco control policy. Philip Morris (PM) ignored, overturned, and weakened various attempts to restrict tobacco advertising, promoting voluntary approaches as an alternative to binding legislation. PM and British American Tobacco (BAT) lobbied separately on tobacco tax structures, each seeking to implement the structure that benefitted its own brand portfolio over that of its competitors, and enjoying success in turn. On excise levels, the different companies took a far more collaborative approach, seeking to keep tobacco taxes low and specifically to prevent any large tax increases. Collective lobbying, using a variety of arguments, was successful in delaying the tax increases required via European Union accession. Contrary to industry arguments, data show that cigarettes became more affordable post-accession and that TTCs have taken advantage of low excise duties by raising prices. Interview data suggest that TTCs enjoy high-level political support and continue to actively attempt to influence policy.Conclusion:

There is clear evidence of past and ongoing TTC influence over tobacco advertising and excise policy. We conclude that this helps explain the country's weak tobacco control record. The findings suggest there is significant scope for tobacco tax increases in the Czech Republic and that large (rather than small, incremental) increases are most effective in reducing smoking.

: Please see later in the article for the Editors' Summary

Published in the journal: . PLoS Med 9(6): e32767. doi:10.1371/journal.pmed.1001248

Category: Research Article

doi: https://doi.org/10.1371/journal.pmed.1001248Summary

Background:

The Czech Republic has one of the poorest tobacco control records in Europe. This paper examines transnational tobacco companies' (TTCs') efforts to influence policy there, paying particular attention to excise policies, as high taxes are one of the most effective means of reducing tobacco consumption, and tax structures are an important aspect of TTC competitiveness.Methods and Findings:

TTC documents dating from 1989 to 2004/5 were retrieved from the Legacy Tobacco Documents Library website, analysed using a socio-historical approach, and triangulated with key informant interviews and secondary data. The documents demonstrate significant industry influence over tobacco control policy. Philip Morris (PM) ignored, overturned, and weakened various attempts to restrict tobacco advertising, promoting voluntary approaches as an alternative to binding legislation. PM and British American Tobacco (BAT) lobbied separately on tobacco tax structures, each seeking to implement the structure that benefitted its own brand portfolio over that of its competitors, and enjoying success in turn. On excise levels, the different companies took a far more collaborative approach, seeking to keep tobacco taxes low and specifically to prevent any large tax increases. Collective lobbying, using a variety of arguments, was successful in delaying the tax increases required via European Union accession. Contrary to industry arguments, data show that cigarettes became more affordable post-accession and that TTCs have taken advantage of low excise duties by raising prices. Interview data suggest that TTCs enjoy high-level political support and continue to actively attempt to influence policy.Conclusion:

There is clear evidence of past and ongoing TTC influence over tobacco advertising and excise policy. We conclude that this helps explain the country's weak tobacco control record. The findings suggest there is significant scope for tobacco tax increases in the Czech Republic and that large (rather than small, incremental) increases are most effective in reducing smoking.

: Please see later in the article for the Editors' SummaryIntroduction

The collapse of communism in 1989 prompted the split of Czechoslovakia into the Czech Republic and Slovakia in 1993 [1]. It also prompted economic reforms that led to the privatisation of the state-run tobacco monopolies, Tabak Akciová Společnost (hereinafter referred to as “Tabak”) in the Czech Republic and Československý Tabakový Priemysel in Slovakia. This provided opportunities for transnational tobacco companies (TTCs), which are known to have exploited privatisation processes elsewhere [2],[3],[4],[5].

More recently, in 2004, the Czech Republic joined the European Union (EU), which brought with it a requirement to implement EU Directives on tobacco control [6]. Despite this, tobacco control remains weak in the Czech Republic. Between 1990 and 2000, real cigarette prices fell [7] and in 2010, its tobacco control policies were ranked the fourth least effective in Europe [8]. Furthermore, senior political figures publically support the tobacco industry. For example, while opening Philip Morris' (PM) Kutna Hora factory in September 2010, the Czech President Vaclav Klaus commended PM's contribution to the country and challenged EU tobacco regulations, reportedly stating: “I support the fight against restrictions on smoking. […] This is stupid; it is unreasonable and something that politicians should not do” [9]. The Czech Republic also remains the only EU Member State that has not yet ratified the Framework Convention on Tobacco Control (FCTC). Despite this worrying state of tobacco control, no previous studies have examined tobacco industry influence in the Czech Republic.

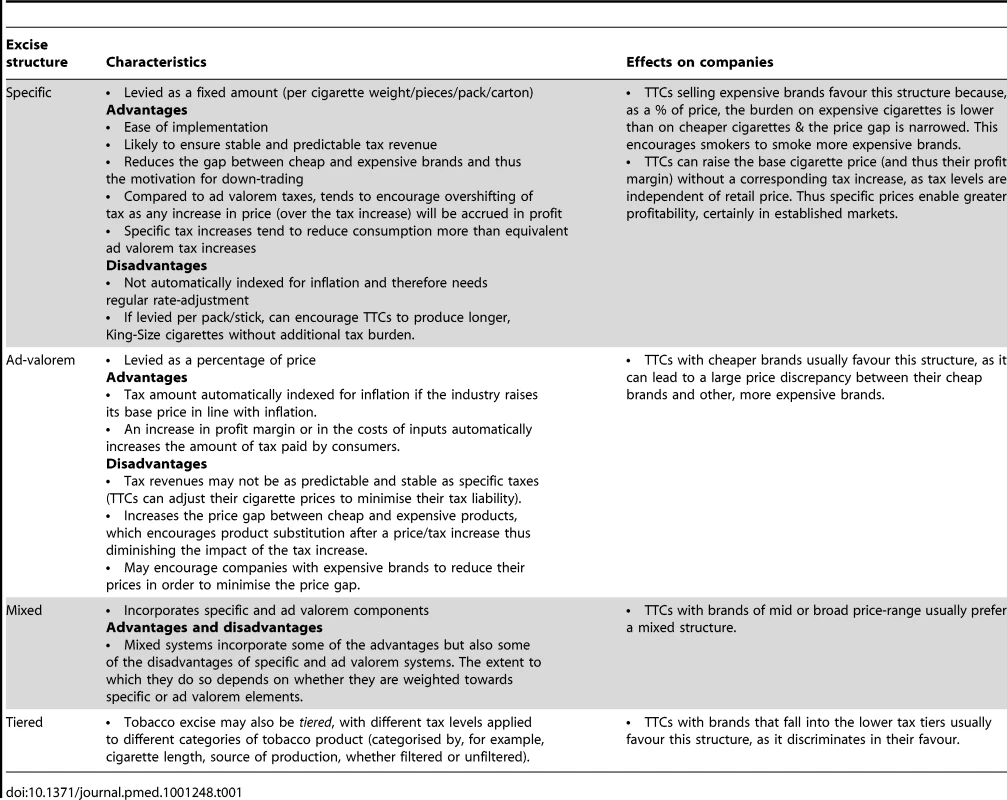

This paper addresses this gap. Examining the period from 1989 onwards (thus covering the key political events of privatisation and EU accession), it aims to explore three main issues: (i) the tactics of market entry; (ii) TTC influence on tobacco marketing restrictions; and (iii) TTC influence on tobacco taxation in the Czech Republic. In so doing, it aims to improve understanding of both effective excise policy and the ways in which TTCs seek to influence policy in emerging markets. Taxation is of particular interest because it is highly effective in reducing tobacco consumption [10],[11],[12],[13] and raises revenue for governments [14],[15]. It also influences TTCs' competitiveness, because different excise systems favour different brand portfolios (the collection of brands that each company sells, usually across a range of price segments; see Table 1). Nevertheless, only a limited literature explores TTCs' efforts to influence tax policies, and most studies focus on North America and deal exclusively with tax levels [16].

Tab. 1. Tobacco excise structures and their effects on tobacco companies.

Methods

This study used a qualitative design, which centred on analysing internal tobacco industry documents released through a series of litigation cases in the US. These data were supported by, and triangulated with, an analysis of other publicly available documents and nine interviews with key informants. The tobacco industry documents were searched via the Legacy Tobacco Documents Library website (http://legacy.library.ucsf.edu/). The date range was restricted to 1989 onwards (covering privatisation and accession to the EU), although undated documents were also included. A broad initial search using the following string: Czech* AND (tax OR taxation OR excise OR “ad valorem”) yielded 4,785 documents, all of which were briefly examined. The surrounding Bates numbers of particularly relevant documents were also checked. Relevant documents were downloaded to an EndNote library and analysed in chronological order, after which further searches were undertaken to follow up specific events, organisations, and individuals. As the initial analysis indicated that TTCs had also been involved in influencing non-tax policies, notably tobacco advertising bans, additional searches also focused on these activities. 511 documents were analysed in detail, using the tobacco document methodology developed by Gilmore [17], which is informed by a socio-historical approach [18],[19]. The majority of documents identified as relevant to this work were PM and British American Tobacco (BAT) documents. This reflects both the nature of the document collections (access to TTC documents is limited mainly to those of PM and BAT, as documents of companies that were not party to the US litigation are not publically available) and the fact that these two companies have dominated the Czech market since transition. The most recent, relevant document identified was dated 2004/5, although only 32 documents date from 2000 onwards.

Additional data sources, including tobacco industry journals, newspaper articles (obtained via Nexis database searches), and market reports (e.g. Euromonitor, ERC Statistics) were used to triangulate this analysis and to provide more recent data. Semi-structured, key informant interviews were undertaken in November 2010. Interviews were conducted face-to-face in Czech by a native Czech speaker with tobacco control expertise. Potential interviewees were selected by a snowball technique; eight out of 11 individuals approached agreed to be interviewed and for their interview to be recorded. Attempts were made to include all relevant stakeholder groups, and we were successful in interviewing a broad spectrum including a public health expert, a civil servant, a tobacco industry representative, a politician, and a political advisor. The primary topics in the interview schedule included changes to and influences on excise policy at EU and national levels including individual and collective efforts of the TTCs to influence policy, dealings with the tobacco industry or third parties representing the industry, provision of advice on tobacco control policy, tobacco smuggling, industry pricing strategies, EU accession negotiations and influence thereon, and the FCTC. Interview transcripts were analysed using the Framework approach [20],[21], in which qualitative data are coded and organised according to themes and sub-themes, allowing for the incorporation of both a priori themes and those which emerge through the analytical process. Observations from interview notes were used to help provide a context for the analysis.

Results

TTCs Entry to the Czech Market and Efforts to Achieve Market Dominance

In 1991, the government commenced a process of privatising the Czech and Slovak tobacco monopolies. Multiple TTCs (PM, BAT, Reemtsma, Rothmans, and R.J. Reynolds [RJR]) prepared to enter the market [22],[23], which was deemed of strategic importance because of its central European location, favourable economic prospects, and borders with other former socialist countries the TTCs hoped to access [24],[25],[26]. Both PM and BAT perceived shaping the tobacco tax system as an important step towards securing market share and future profits [27],[28],[29],[30].

Prior to market opening, legal TTC sales in Czechoslovakia occurred only through hard currency and Duty Free Shops [31], which were unavailable to the general population. However, by 1991, documents suggest that cigarette smuggling into Czechoslovakia was commonplace; a BAT agent estimated that 70% of BAT's and 90% of PM's cigarettes on the market were “smuggled” [32]. Moreover, tobacco marketing was already widespread with TTC brands among those heavily marketed [32].

In March 1992, in the western part of Czechoslovakia (now the Czech Republic), Tabak was put out to tender [22],[33]. PM, which had a close working relationship with the Czechoslovakian government and Tabak (through a licensing agreement established in 1987 to produce PM's most prominent brand, Marlboro [34],[35]), successfully convinced the government to abandon its plan to break up Tabak [22],[36],[37]. In April 1992, PM acquired a 30% share (the largest US investment in the Czech history at the time) [35] and by 1993, it had gained a majority holding (67.4%) [27] and thus monopoly power over the domestic market.

The Czech government had planned to abolish the law giving PM (via ownership of Tabak) a monopoly on cigarette production [38] but, according to BAT, PM attempted to maintain its market dominance by trying to impede this change [36],[39],[40]. BAT repeatedly lobbied key government officials [39],[41],[42],[43],[44], arguing that failure to change the legislation would “inhibit the establishment” [40] of the “truly free market for tobacco products” [40] to which the Czech government had committed [40]. Documents suggest that BAT's lobbying efforts (on which it spent at least £120,000 by June 1993 [45]) were successful [45],[46],[47],[48],[49], ultimately enabling BAT to establish a small production facility in May 1995 [50],[51].

PM therefore turned its attention to maintaining its market leadership via other means [52]. A notable example is PM's support for and direct engagement with the Czech authorities to introduce a tax stamp system in the mid-1990s [53],[54],[55],[56], demonstrating its apparent concern about “competition from illegally imported cigarettes” [57], which included competitor TTC brands [58]. To PM's satisfaction [54], the tax stamp system was implemented in 1994 and helped contain levels of contraband at around 3% of sales for a few years [54],[59].

TTC Efforts to Influence Marketing Restrictions

Prior to market entry, some marketing restrictions were introduced in Czechoslovakia, notably a 1992 Consumer Protection Act, which stated that it was “forbidden to advertise tobacco products” [60]. However, TTCs ignored this, posting large adverts on billboards, store fronts, and city trams [61],[62]. PM claimed that the Act could not be enforced until officials had further defined it [62] and pursued “all available means to obtain a favourable amendment” [63],[64],[65],[66],[67]. It used a previously established organisation, Libertad, which, although fully funded by PM, positioned itself as not-for-profit [68],[69],[70]. Supported by the global public relations company Burson-Marsteller [70], Libertad helped frame freedom to advertise tobacco products as a matter of commercial free speech [64],[71],[72]. The campaign was successful and the advertising ban was formally cancelled in July 1993 [48],[63]. PM subsequently worked to produce a voluntary code of conduct [48],[68],[73], presumably to decrease the likelihood that another legislative ban would be proposed (a tactic used elsewhere [74]).

However, to PM's apparent surprise, a further advertising ban was passed in December 1993, which PM again worked “to reverse” [53],[75],[76],[77], promoting self-regulation as an alternative [77]. In February 1994, a vote on relaxing the ban was passed, allowing existing tobacco advertising contracts to run until December 1994 or until a new law was passed [78],[79], meaning that, although tobacco advertising was technically banned, it still existed throughout the country [61]. Just days prior to this vote, PM had taken five Czech Members of Parliament (MPs) to a two-day all-expenses paid “briefing trip” to Switzerland [77],[80], where a tobacco and alcohol advertising ban had recently been rejected in a referendum vote following a PM campaign [81]. Two of these parliamentarians voted in favour of amending the ban and the others abstained or were absent [80]. Soon after the vote, the Czech Prime Minister committed the government to completely cancelling the advertising ban and seeking alternative legislation [79].

The government started working on a new advertising law in March 1994, and by April 1994, PM had become directly involved with its development [77]. The new law was approved in October and in line with PM's objective, relied on self-regulation [77]. PM managers regarded this as a success [77],[82] and planned to use a similar, voluntary code to try to overturn the advertising ban still in place in Slovakia [82]. PM documents note that a “behind the scenes approach” helped them achieve success [77]. A key component of this approach was the establishment of the Council for Advertising, an organisation made up of advertisers and the media which was charged with administering an industry marketing code, closely modelled on PM's own internal code [77],[83]. At least two documents suggest PM was involved in establishing the Council for Advertising [77],[83] and another suggests PM helped fund it [84].

By 1994–1995, the Czech Parliament approved an amendment to the Law of Prevention of Alcoholism and Other Drug Addictions, which included a ban on day-time TV and radio advertising for tobacco products [85]. However, the law was rejected by President Havel [86],[87],[88], following “several weeks of intensive lobbying by the industry” [88].

TTC Efforts to Influence Tobacco Excise Policy

Influence on excise policy during privatisation

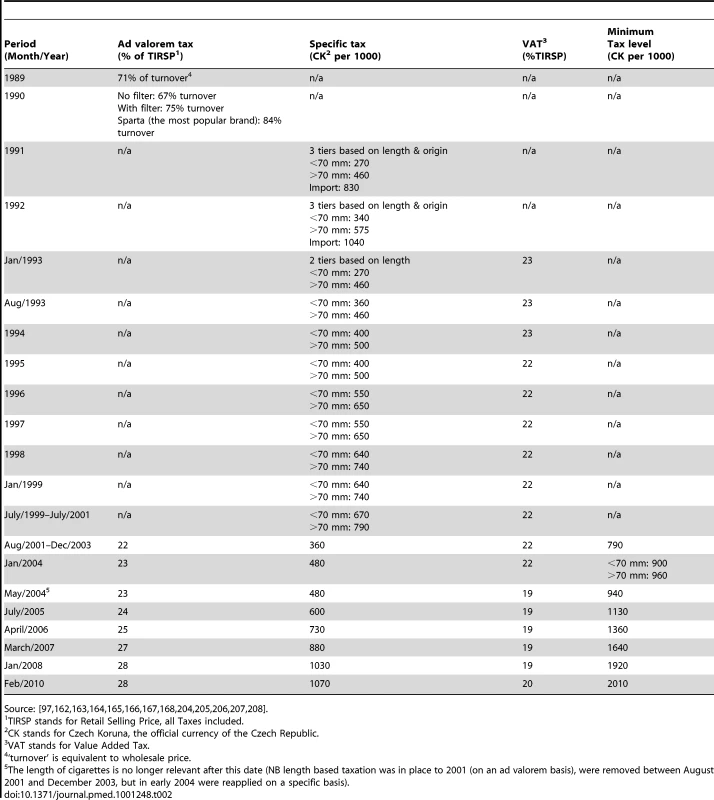

Both PM and BAT tried to influence tax policy before, during, and after the privatisation process and both generally wanted to minimise tobacco tax levels [89],[90],[91],[92]. However, each had different approaches to excise tax structure, in line with their contrasting brand portfolios [93],[94],[95],[96]. PM's portfolio is dominated by the premium brand Marlboro. As fully specific excise structures benefit expensive brands (Table 1), PM's objective was to replace the fully ad valorem (proportional) structure then in place (1989–1990: see Table 2) [97] with an entirely specific excise tax structure [93]. Although documents do not specify that a single-rate (i.e., not tiered) specific system was the ultimate objective, we assume this was the case from the objectives PM outline; the specific system was intended to reduce the price gap between Marlboro and others' cheaper brands, in order to eliminate the cheaper brands' “price advantage” [93] and enable consumers “to choose their cigarettes based on product quality and brand image rather than price” (i.e. to choose its more expensive brands) [98]. Accordingly, PM promoted a fully specific excise tax structure after its acquisition of Tabak in 1992 [89].

Tab. 2. Cigarette excise structures and levels in Czechoslovakia/Czech Republic, 1989–2009.

Source: [97],[162],[163],[164],[165],[166],[167],[168],[204],[205],[206],[207],[208]. BAT, which had a more diverse cigarette price portfolio with a greater emphasis on the economy price segment than PM, wanted to shape the excise tax structure differently [95],[96]. We have been unable to find any documents that clarify precisely what BAT envisioned, but the company's broad European strategy at this time was to achieve a mixed excise structure (combining an ad valorem tax with a significant specific component) [99],[100]. Given the rationale for this system was that it would disadvantage PM's more expensive brands [101], it is likely that BAT was trying to achieve a mixed excise tax structure in the Czech Republic. By 1990, both companies were actively lobbying to influence excise tax policy [25],[102]. In 1991, BAT met with Mr. Antonin Kalina of the Czechoslovakian Ministry of Finance to offer the company's “worldwide tax experience” [103]. However, BAT's lobbying efforts were initially unsuccessful and a specific excise tax structure was implemented in January 1991 (Table 2) [26], which continued to disadvantage its brands [104].

Although the excise structure implemented in 1991 was specific (in line with PM's preferences), it also incorporated three tiers, based on both geographical origin and length of cigarettes (Table 2) [26]. This did not offer PM the advantages of a normal, single-rate specific system (Table 1), given that both long cigarettes (largely produced by TTCs) and imports (on which the TTCs then relied [28],[36]) were taxed most highly. In January 1991, PM became concerned with the discriminatory effects of the tiered structure on foreign brands, which “incur approximately double the tax burden that is applied to domestic filter cigarettes” [28] and claimed it contravened the principles of General Agreement on Tariffs and Trade because it discriminated against foreign goods [28], a tactic PM had previously employed in Hungary [28],[105].

Although the tiered tax structure remained in place until 2001, once PM had acquired Tabak, thereby starting to produce shorter (lower taxed), local cigarette brands, the structure became “extremely beneficial to Philip Morris” [106]. Nevertheless, PM remained unhappy with the significant price gap between Marlboro and other brands [67], as it hindered its broader plan for new markets: to buy up local brands with the long-term goal of trading “consumers up to premium brands,” notably Marlboro [107]. This would increase returns given the greater profit margins generally enjoyed on premium brands. A predominantly specific tax structure and a willingness to temporarily absorb tax increases (to make Marlboro more affordable) were central to this strategy:

“In expansion areas (excluding Japan) affordability is the key issue and managing the price gap between Marlboro and the next pricing category is the critical strategy. To do so requires selective pricing including choosing to absorb tax increases partially or in full.” [107]

Accordingly, PM lobbied the Ministries of Economic Competition and Finance and relevant parliamentary committees [48],[63] with apparent success. PM documents from 1993 and 1994 report that the company obtained a reduction in the tax difference between tiers by raising the tax burden on short cigarettes (Table 2) [63],[67].

In arguing for its preferred excise tax system, PM also tried to “resist any linkage by governments” [108] of health objectives to tobacco taxes, probably because this linkage is recognised by TTCs as providing a rationale for governments to increase tax and/or “earmark” revenue for health programmes [16].

Outcomes of TTC influence on excise during privatisation

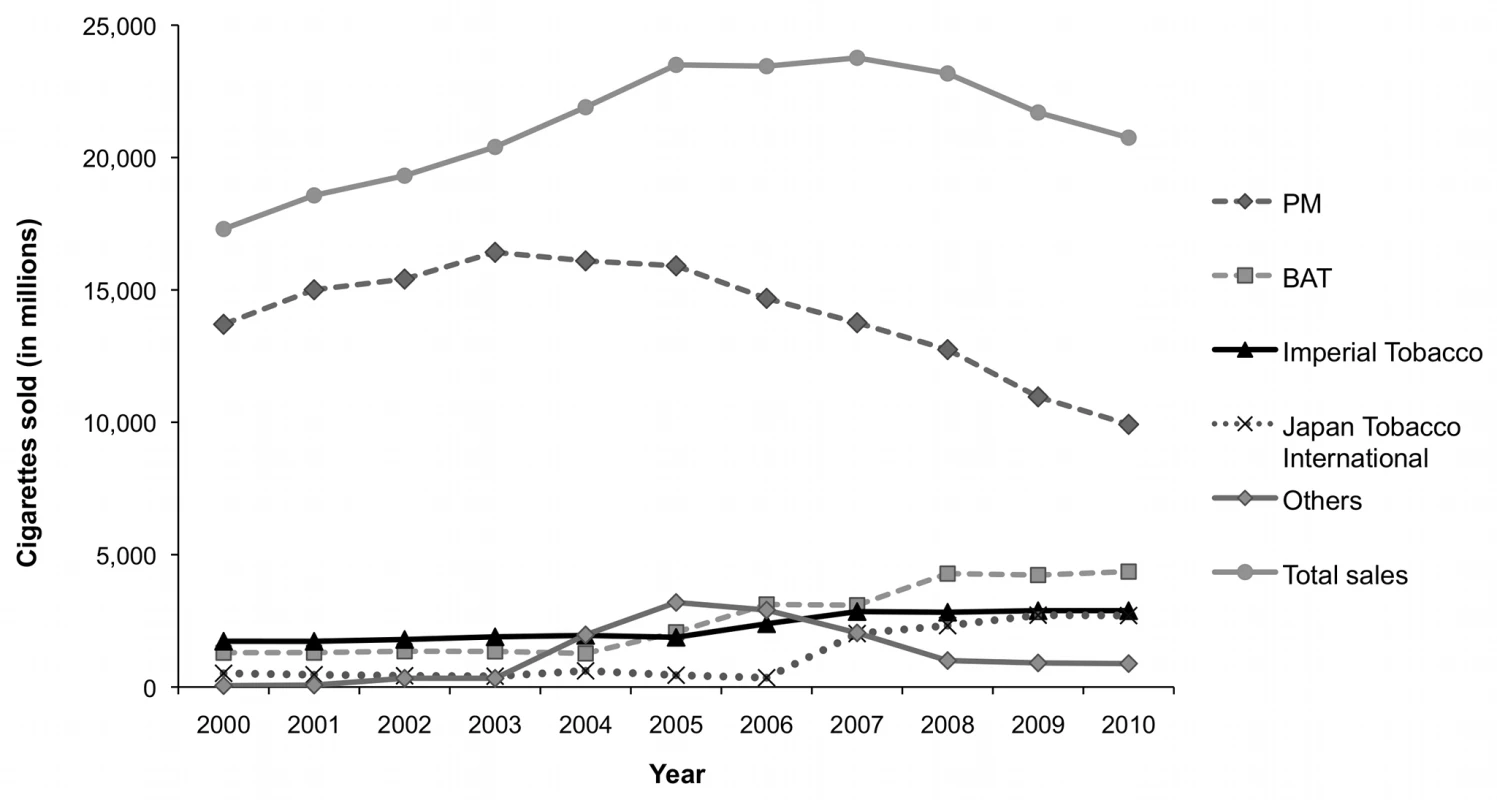

Although PM did not achieve its ultimate aim of a single-rate specific excise structure, it still successfully influenced excise policy in its favour during the early to mid 1990s, most notably by increasing the tax on short cigarettes and thereby narrowing the difference between the tiers. According to market reports, this appears to have had a direct impact on sales and market shares. The sale of short cigarettes fell rapidly in the mid-1990s, with king-size (i.e. larger, generally international cigarettes [109],[110]) coming to hold over three-quarters of the market [59]. By 2000, PM had achieved an 80% market share (Figure 1) [59].

Fig. 1. Cigarette sales by volume (in millions) overall and by company in the Czech Republic, 2000–2010.

Influence on Excise Policy during EU Accession

EU accession required the Czech Republic to implement all EU legislation including EU tobacco tax directives [6]. As such, it was required to implement the EU's minimum excise requirement (a 57% excise tax rate on the Most Popular Price Category [111]) and to put a mixed excise system in place. In the Czech Republic, this required increasing tobacco taxation levels and adding an ad valorem element to the existing specific excise tax. Efforts to influence excise policy during the accession process focused on these two issues.

Delaying implementation of the EU minimum excise requirement

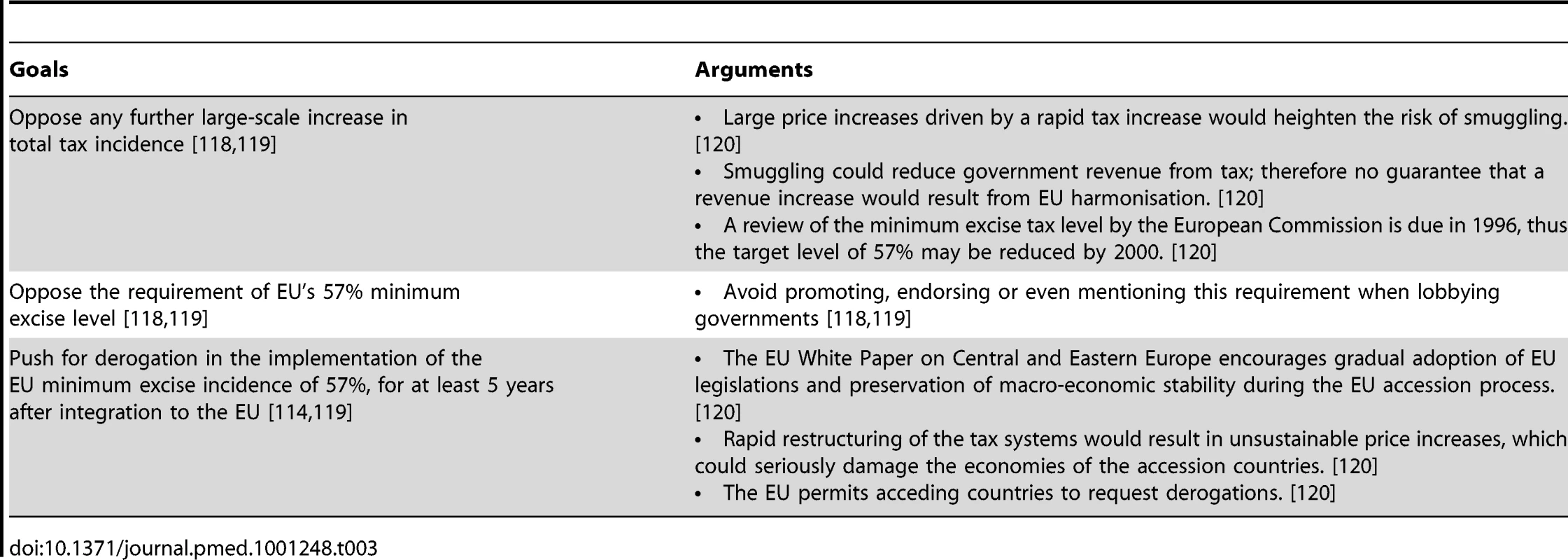

In late 1993, aware of the requirement for EU accession states to implement EU tobacco tax directives, the TTCs operating in these countries attempted to overcome their rivalries and develop a united position on tax issues [112],[113]. They recognised that “lack of industry coordination in communicating with relevant officials” [113] on tax issues had previously undermined the industry's credibility [112],[113], and could induce governments to “act against the long-term interests of… the industry” [92]. BAT, which was generally in favour of mixed excise systems (see above), was particularly forthright about the benefits of a united approach, claiming this was “the most effective way to improve industry and BAT ['s] control” in the acceding countries [114]. TTCs began discussing tax issues at Eastern Europe Working Group meetings around 1993 [92],[115],[116] and subsequently established the Central Europe Tax Task Force [113] to promote a “consistent approach and argumentation” [113],[117]. In 1996, the Central Europe Tax Task Force began working to achieve united tax harmonisation goals in Central European countries, including the Czech Republic [113],[117],[118].

One important, unanimously agreed goal of the Central Europe Tax Task Force was to oppose any large-scale increases in total tax incidence [117],[118],[119]. Accordingly, the TTCs aimed to obtain a 5-year derogation period for the Czech Republic's requirement to implement the 57% minimum excise requirement [114],[119], expressing concerns about “unsustainable price increases” [120] and heightened risks of smuggling [120]. A note of a Working Group meeting in February 1996 indicates that members planned to suggest to governments of the Central and East European countries that the 57% minimum requirement might be reduced [120], although we could find no evidence to support this claim. In fact, the history of the development of EU tax directives shows that excise levels have consistently increased, rather than fallen, over time [121]. Later in 1996, all members of the Central Europe Tax Task Force agreed to avoid endorsing, or even mentioning, the 57% minimum requirement when lobbying (see Table 3 for a more detailed overview of the arguments TTCs planned to use to promote the need for derogation) [118],[119]. The industry's desire to avoid any major increases in tax (and thus price) is consistent with financial analyst reports, which indicate that small, gradual tax increases can actually benefit the industry [122],[123]. Analysts suggest this is because, unlike large tax increases, incremental increases have relatively little impact on consumption and can also enable overshifting (where TTCs increase prices on top of the excise increases, thus increasing profits) [124]. TTCs' strong preference for gradual tax increases was acknowledged in two separate interviews:

“They [the TTCs] did not mind gradual increases [during EU accession], but they feared major jumps. They said: if you want an increase by, say, 20%, break it down to 5% a time. But that's a scam. It would be easier for family budgets to adjust to a gradual increase… They knew a smoker would resist for two or three days and then cave in. But they [were] afraid of a significant jump, which would mobilise the smokers to quit smoking.” (Anonymous, ex-MP).

“[T]he Czechs know that our fiscal situation is such that taxes will simply go up. The trick is not to do this in jumps but via gradual provisions because the market will get used to it.” (Economist and consultant to Czech political parties)

Tab. 3. The tobacco companies' agreed tax harmonization goals and arguments for Central European countries (Czech Republic, Poland, Hungary, Slovakia, Romania).

PM commissioned Arthur D. Little International (a consultancy company TTCs often used [125]) to conduct an economic impact study to counter proposals for excise increases in the Czech Republic [126]. The study, published in 2000, claimed that the Czech government gained six billion Czech Koruna (approximately US $150 million) from high smoking rates in 1999, due to the reduced healthcare and social costs caused by the early deaths of smokers [126],[127]. This study was subsequently criticised from both economic [128],[129] and moral perspectives [130],[131], and PM was forced to make a public apology [130],[132],[133].

Disagreements on implementing the mixed tax structure

Although the Central Europe Tax Task Force acknowledged that a mixed system was required [118], in line with the differences in brand portfolios outlined above, the TTCs had different views as to what mix was preferable [117],[119]. Despite agreeing to push for derogation on the EU's required minimum level of taxation, the industry could not agree on how quickly harmonisation of tax structures should occur in pre-accession, Central European countries [113],[118]. PM wanted to maintain a fully specific system for as long as possible in the Czech Republic and planned to lobby separately on this [134]. BAT, whose focus on cheaper brands [135] would benefit from a system incorporating an ad valorem element (Table 1), preferred faster harmonisation with the EU mixed tax structure [113]. This rift motivated BAT and PM to pursue separate avenues of excise policy influence in the Czech Republic, while also continuing to meet as an industry group.

In 1996, having confirmed “the legal allowance of political contribution” [136], PM organised a “contribution” [137] totalling $300,000 to three Czech political parties that it felt were “consistently pro-free trade and pro-market economy” [138] and “pursued reasonable politics on excise taxation” [138]. These were the three dominant political parties at that time: the Civic Democratic Party (then the senior Government coalition party, led by Vaclav Klaus, then Prime Minister), the Christian and Democratic Union - Czechoslovak People's Party (the second largest party in the Government coalition), and the Civic Democratic Alliance Party (a junior coalition party which held the posts of Minister of Trade and Industry, Minister of Privatisation, and Head of the National Property Fund) [138]. As highlighted by one interviewee:

“They were very clever about it because they made contributions to all [important] parties so that all of them would be in their debt.” (Anonymous, ex-MP)

According to an investigation widely quoted in the Czech media, PM (alongside two steel companies) deliberately sought to obscure the origin of these donations by channelling them through an offshore account [139],[140] (e.g. see footnote 13, p289 in reference 140), a claim which resulted in the resignation of the Deputy Prime Minister, Jiri Skalicky [141],[142],[143]. Two interviewees suggested that transparency in donations to political parties and individual MPs is an ongoing concern.

“Today, unfortunately, the political parties no longer make their sponsors' names public… It's most probably continuing, but in a way we know nothing about.” (Public Health Advocate)

“I remember them [TTCs] paying for something for the MPs, but I can't remember the details now, and we stand no chance of ever finding out. These are experienced people, and they know how to do their business.” (Ex-MP)

BAT appears to have focused its lobbying at the EU level, convening a board-level lobbying visit to the European Commission in November 1997, where they held a series of meetings with high-level European Commission officials, including officials in the Directorate-General for Internal Market and Services and the Directorate-General for Customs and Indirect Taxation, Irish Commissioner Padraig Flynn, United Kingdom Permanent Representative staff and the Vice-President of the European Commission, Sir Leon Brittan [144],[145],[146],[147],[148],[149],[150],[151],[152],[153],[154],[155],[156],[157]. These meetings were designed to facilitate useful, long-term EU connections and signal BAT's importance in Europe [144]. BAT also planned to claim that their business in Eastern Europe suffered from “arbitrary policy-making in key areas, particularly taxation” [144] and that BAT therefore supported “early enlargement” [144] of the EU to expedite adoption of the EU's mixed tobacco excise structure [144]. BAT further planned to offer its “world-wide expertise” [144] on taxation issues to officials in the accession countries and to present itself as a “neutral partner” [144] of the EU and its member states. Our interview data suggest that TTCs are continuing to position themselves as experts on tobacco taxation who can “educate” less-knowledgeable officials:

“You must generate long-lasting relations and you must offer them some specific knowledge. Tobacco tax is a very complex business. There are 200 people in the [Czech] House of Representatives who have all kinds of professions (one is a doctor, another an engine driver, another an engineer). How many of those understand consumer tax on tobacco?” (Anonymous, tobacco industry employee)

In 1998, BAT succeeded in persuading other TTCs to agree on the “BAT path of thinking regarding tax in Central Europe” [158], despite PM's disdain for a mixed structure. Minutes of a BAT-led Central Europe Tax Task Force meeting in January 1998 state PM, Reemtsma, RJR, and BAT unanimously agreed to cooperate on supporting the implementation of a mixed tax structure which complied with EU requirements [159].

Outcomes of TTC influence on excise during accession

The Czech Republic was granted two derogation periods on tobacco excise levels when it officially joined the EU in May 2004 : 32 months to raise the minimum level to 57% and 44 months to increase the minimum level to 64 euro/1000 cigarettes in the Most Popular Priced Category. This represented a partial success for TTCs, as they had hoped to achieve a five-year derogation period. No derogation was granted on implementing the mixed structure [160], which was consistent with BAT's preference, and as of 01 August 2001, a mixed structure (i.e. with both ad valorem and specific components; see Table 2) was introduced.

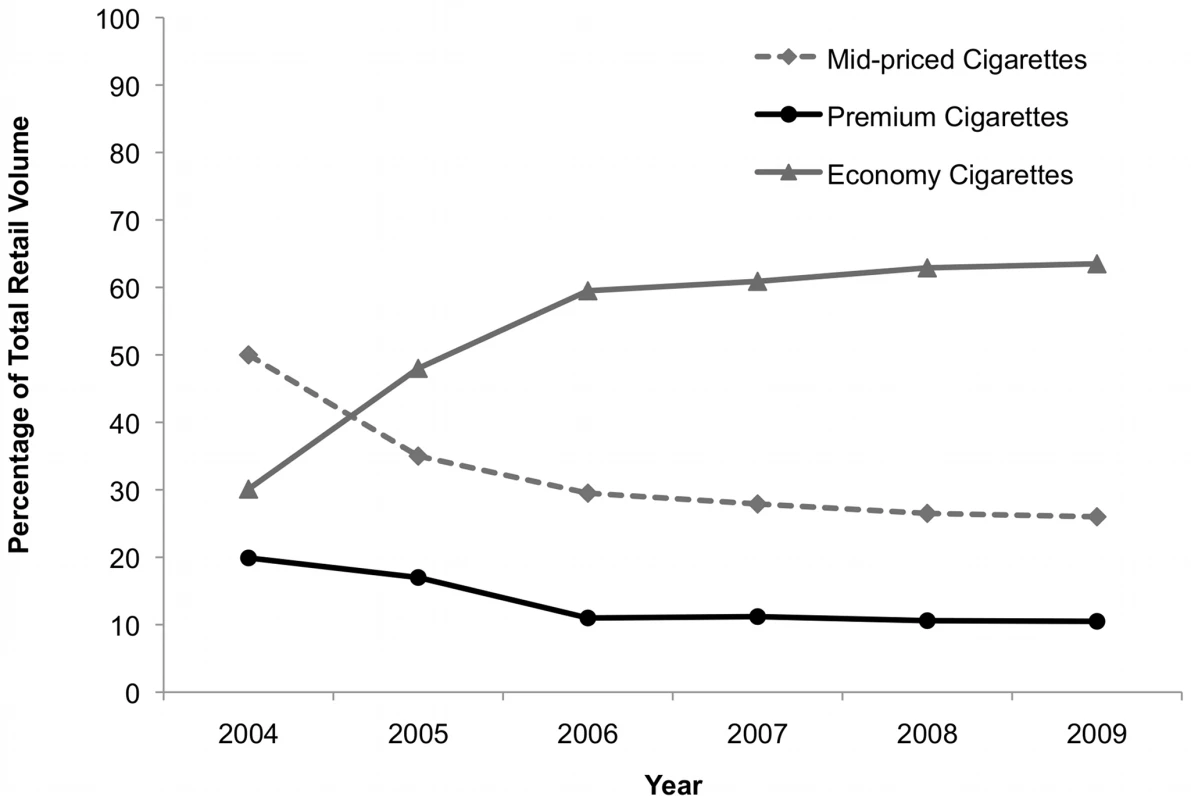

The TTCs' shares of the tobacco market in the Czech Republic have changed dramatically since the 2001 change from a specific to a mixed tobacco excise regime. PM's market share dropped from around 80% in 2000 to under 50% in 2010, while BAT's share more than doubled to 21% (Figure 1) [59],[161],[162],[163],[164],[165],[166],[167],[168],[169],[170],[171]. While these changes are consistent with the mixed excise structure advantaging BAT over PM, other factors may have also played a role. First, EU accession in 2004 enabled TTCs to supply cigarettes from any production base in the EU without incurring import duties, effectively removing most of the benefits previously associated with local production [59],[172]. This appears to have prompted BAT and PM to close domestic production facilities in the Czech Republic in July 2004 and 2005, respectively [59],[173]; BAT is now supplying the Czech market solely by imports, while PM retains production at its Kutna Hora factory [59]. Second, in line with trends elsewhere in Europe, an economy cigarette sector quickly emerged around this time [59] and has continued to grow (Figure 2) [174]. This could also have hurt PM's market share as its strategy focused on pushing premium brands, although some analysts suggest PM's failure to improve sales may be attributable to its altered distribution system [59].

Fig. 2. Volume market share by price segment in the Czech Republic, 2004–2009.

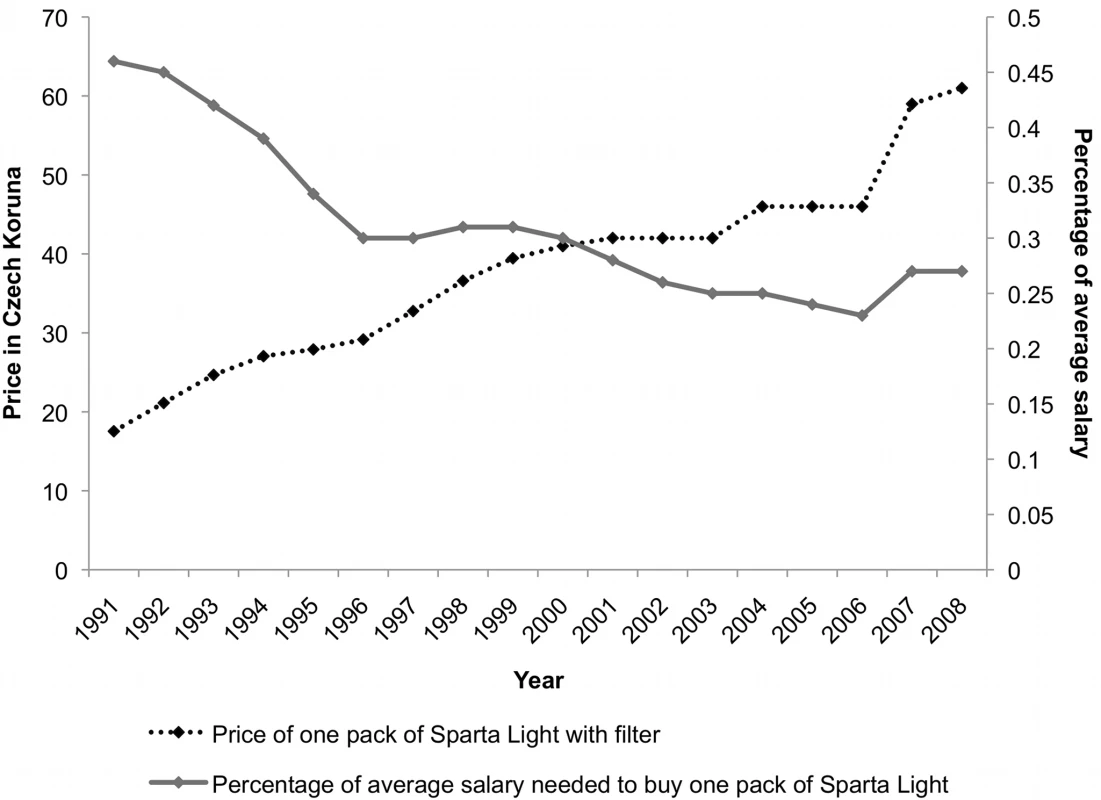

Despite five relatively small excise tax increases between EU accession in 2004 and 2010 [59],[171], cigarettes are becoming increasingly more affordable due to rising income levels (Figure 3). TTCs are taking advantage of this situation by overshifting tax increases and thus increasing profits [174]. Nevertheless, cigarette prices remain low [8] and the country's current tobacco excise yield is one of the lowest in the EU [170].

Fig. 3. Price of, and the percentage of average salary needed to buy, one pack of cigarettes in the Czech Republic, 1991–2008.

Given the ineffectiveness of tobacco excise policy in the Czech Republic, it is unsurprising that smoking prevalence rates have changed little since 2000 [175],[176] and that cigarette sales increased between 2000 and 2007 (Figure 1). Although they have since fallen, this decline has been largely attributed to market conditions rather than tobacco control policies [171],[174].

Continued TTC Influence in the Czech Republic: Interview Data

Since joining the EU, the TTCs have continued their intensive lobbying efforts in the Czech Republic (various interviews), with PM viewed as the most active (interview, civil servant). Political support for the industry appears to be higher than in many European countries with, for example, one of our interviewees arguing that s/he “didn't see a problem with” President Klaus' decision to open the PM's new factory (Czech Member of the European Parliament).

Our interviews provide examples of how PM and the other TTCs continue to court high-level politicians, at both the national and the EU levels, sometimes disguising their involvement:

“I was once invited [last year] to a round-table conference to which legislation experts, customs officers, and the Ministry were invited, and there were representatives from tobacco companies too. It was under the auspices of some training company, but in my opinion, it was the tobacco people who organised it.” (Anonymous, civil servant)

“Last week, there was a social event in Malostranská Beseda [177] organised by Phillip Morris, in which 54 MPs and Senators participated… …We never had 54 come to our [tobacco control] seminars. One or two, maybe…There are 200 MPs and 81 Senators, so 54 is a good amount.” (Public health advocate)

Other interviewees mentioned this expensive reception, one noting that at least one minister attended. Furthermore, one interviewee named three high-level politicians and two members of the presidential team who “represent the views of the industry” (interview, public health advocate), suggesting that industry efforts to court political support remain successful. Interestingly, the tobacco industry interviewee was very keen for us to interview one of these politicians, Senator Kubera, who regularly campaigns against Czech tobacco control proposals [178],[179],[180],[181], claiming:

“Senator Kubera knows about smoking issues about 15 times more than does Dr. Šťastný [an MP currently campaigning for an earmarked excise tax on cigarettes to fund health care]. In any case, his view of the issues is much more relevant than that of Šťastný.” (Tobacco industry employee)

Discussion

This paper documents extensive evidence of tobacco industry policy influence in the Czech Republic, including over the privatisation process, tobacco advertising, tax levels, and structure. This detailed case study is important as it elucidates industry influence on tax policies, which have not been well researched outside North America [16]. The findings are likely to be particularly relevant for other Eastern Europe countries, many of which experienced similar economic reforms and a process of tobacco industry privatisation around the same time as Czechoslovakia/the Czech Republic. More broadly, the findings draw attention to a range of strategies for influencing policy and gaining market share that tobacco companies may employ in emerging markets. Both privatisation and EU accession provided opportunities for TTC influence. PM was most successful in exploiting the former and BAT the latter, and the successes are reflected in subsequent market share trends (Figures 1 and 2). It is also clear that the industry continues to enjoy high-level political support and access, to a degree that is now rare in many other parts of Europe [182],[183].

On privatisation, we demonstrate that PM attempted to avoid a competitive tender and, having effectively established a production monopoly, sought to influence the monopoly legislation to preclude competition. This substantiates previous evidence that TTCs may attempt to establish monopolies [5], whilst simultaneously extolling the benefits of free market competition [64]. This conduct was previously documented only for BAT [10],[105],[184], but this paper provides evidence of PM acting in the same way.

On advertising, we show that TTCs worked hard to prevent and undermine advertising legislation between 1989 and 1995, ignoring initial legislation and supplanting further proposals for binding advertising bans with a voluntary approach. This is a tactic TTCs have used elsewhere [5],[185],[186],[187] and reveals a consistent industry preference for voluntary over binding controls on marketing [186].

In relation to tobacco excise policy, we document a number of important findings with key relevance for policy. First, in relation to tax levels, both PM and BAT generally aimed for low excise levels. This was particularly so at the point of market entry, when PM was even willing to absorb taxes in order to ensure its brands remained affordable (i.e. to undershift tobacco taxes)—a TTC tactic documented elsewhere [188]. On EU accession, it is clear the industry made concerted and successful efforts to delay the excise increases required. Indeed cigarettes became more affordable post-accession (Figure 3). This indicates that opportunities to improve tobacco control were missed during the accession process, a point that has been previously made [6]. Second, the TTCs angled for gradual, small tax increases (as opposed to intermittent, large increases). This practice is documented during both privatisation and accession and is noted by at least one interviewee. Our data suggest this is because intermittent, large increases are more likely to prompt smokers to quit: a finding consistent with reports of very substantial declines in cigarette consumption following large tax increases in France, Germany and Ukraine [189],[190]. This indicates that intermittent, large tax increases would be more effective as a public health strategy—an issue that requires further research. Third, data show that the industry is currently overshifting tax increases (i.e. increasing cigarette prices, and thus profits, on top of the excise increase) in the Czech Republic. This represents extra profits for TTCs and a lost opportunity for the government, which could have collected this additional revenue as tax. Moreover, the fact that TTCs are overshifting taxes goes against their advice to the government to keep prices low.

In relation to excise structures, our findings support existing studies [16] in suggesting that each TTC had a standard approach to excise structure, with PM promoting a specific structure, designed to narrow the price gap between Marlboro and cheaper brands, and BAT promoting a mixed system, to aid its cheaper brands and disadvantage PM.

To achieve policy influence, TTCs targeted key government officials at both national and EU levels, as they have done elsewhere [10],[105],[191],[192], sometimes exploiting a lack of political and policy expertise in tobacco excise as an opportunity to “educate” politicians. Our interviewees suggest this tactic continues and extends to high-level politicians with whom the industry appears to enjoy significant contact and influence. Political donations to “friendly” political parties were used behind cover, with transparency of political funding identified as an ongoing concern. Other tactics include trying to ensure favourable media coverage and commissioning third-party research to boost credibility of the industry claims; again, tactics noted elsewhere [105],[193],[194].

It is worth noting that for some issues, TTCs' approach and argumentation appear to be context-specific (although always with the ultimate aim of securing corporate advantage, including over competitors). For example, PM supported a tax stamp system in the Czech Republic, once it had secured a dominant position, just as BAT did in Uzbekistan [10]. Yet, elsewhere, PM has lobbied against such a system [105]. This differing stance is explained by the fact that tax stamps protect the interest of dominant TTCs with a domestic base by making it more difficult for their competitors to import tobacco products (including illegally). Market research reports suggest the tax stamp system, and later a ban on selling tobacco from street markets, were effective in limiting the illicit tobacco trade [59].

Empirical evidence suggests several of the arguments developed by TTCs to influence excise policy were misleading. For example, in seeking to delay the implementation of the EU's minimum excise requirement, TTCs planned to argue that raising taxes would increase smuggling. Yet, in reality, the evidence indicates that smuggling is more pervasive in countries with low tobacco tax and loose border regulation [195],[196]. TTCs also agreed to contend that increased tobacco taxes could reduce government revenue, when evidence indicates that tobacco tax increases almost always increase government revenue [197]. Furthermore, the TTCs aimed to exploit the argument that the implementation of tax increases to meet the EU's 57% minimum excise level must be gradual in order to preserve the country's macro-economic stability. In reality, it is unlikely that changes in taxation of tobacco, which is not an essential good [14], would have a significant impact on a country's overall economy [190]. The TTCs' desire for gradual tax increases is more likely to relate to their awareness (as described above) that gradual increases are more easily absorbed by consumers. The fact that a significant derogation period was granted to the Czech Republic in relation to the EU minimum excise requirement (albeit a shorter period than the TTCs were hoping for) suggests the TTCs were relatively successful in influencing this process, despite the flawed nature of their arguments. The chief negotiator of the Czech Republic's accession to the EU was Pavel Telička, a former Member of the European Parliament who now works as a lobbyist in Brussels for large companies [198] and as BAT's EU Social Reporting Facilitator [193].

An important limitation of this study is that the document analysis was based primarily on PM and BAT documents, for the reasons explained in the Methods section. We also found very little information regarding the role played by civil society groups in the development of tobacco control policies in the Czech Republic. We found no industry documents on non-governmental organizations' activities in relation to tobacco advertising or taxation. One document even suggests that industry perceived tobacco control activity to be almost nonexistent in the immediate post-communist period [199]. Although the literature suggests that tobacco-control activities had increased by the late 1990s [200],[201], policy advocacy efforts are reported as limited [202], reflecting the “lack of tradition in civic participation” [202].

Overall, our findings suggest that tobacco industry influence plays a key part in explaining the weak tobacco control policies of the Czech Republic. Improvements in tobacco control will probably be possible only if efforts are made to protect policies from the vested interests of the tobacco industry, as enshrined in Article 5.3 of the FCTC [203], and if public and political attitudes to the industry shift. Transparency in political funding and greater policy advocacy by civil society groups could be important steps towards achieving such a shift. More specifically, our findings point to a number of policy recommendations, particularly in relation to tobacco excise policy (Box 1).

Box 1. Conclusions and Policy Recommendations

Recommendations are denoted “R” below.

Tax

-

The tobacco industry will both under - and overshift taxes; its tactics depend on the market structure and economic context. Undershifting is most likely when the market is immature and the tax increase is relatively small. R: Undershifting can be prevented by substantially increasing tobacco excise taxes.

-

Data suggest the industry is currently overshifting taxes in the Czech Republic. While this is less of an issue for public health, it highlights a missed opportunity for the government to increase tobacco excise. R: The Czech Republic should consider increasing tobacco excise, particularly specific excise, for the reasons given above.

-

Tobacco industry claims about tobacco excise policy must be treated with extreme caution. Most arguments aim to serve corporate interests and may be inconsistent with established evidence. The complexity of tobacco excise tax policy, perhaps more than any other area of tobacco control policy, enables the tobacco industry to make misleading arguments and to influence policy inappropriately. R: There is a need to increase understanding among politicians, civil servants, and the public health community of effective tobacco tax policy and of industry efforts to mislead and undermine policy.

-

Large tax increases may benefit public health to a greater extent than incremental increases. R: Further research is needed to explore this issue.

-

Accession to the EU could provide an opportunity to improve public health, but this paper highlights that it can also provide an opportunity for TTC influence. R: If and when other countries join the EU, care must be taken to provide appropriate, independent advice on tobacco excise tax policy. Any estimation of the impact of tobacco excise tax increases that is likely to occur with accession needs to allow for likely changes in income (and thus affordability) of tobacco.

-

Both tobacco stamp systems and preventing sales of tobacco from open-air markets may help reduce illicit tobacco trade. R: These could be effective interventions in other jurisdictions.

TTC Political Links

-

Tobacco-control policies and therefore the health of the public suffer when policymakers maintain connections with the TTCs, as this provides the TTCs a direct avenue for policy influence. R: Article 5.3 of FCTC, if properly implemented, can address this but requires industry actions to be monitored and exposed and greater public and political awareness of industry tactics.

Advertising

TTCs will work hard (often collectively) to prevent any significant restrictions on their ability to promote their products. Legislation may be ignored by TTCs if it is not sufficiently clear, and TTCs are likely to propose voluntary advertising restrictions in order to avoid binding legislative. R: Legislation must be watertight; voluntary advertising restrictions are inadequate.

Privatisation

There is now substantial evidence that, in the context of privatisation, TTCs will: (i) attempt to establish monopoly positions while harnessing the benefits of market liberalisation to access new markets; (ii) seek to keep cigarette excise rates low; and (iii) ensure the freedom to promote tobacco products. R: Tobacco control measures including a comprehensive advertising ban should be implemented and enforced prior to privatisation.

Supporting Information

Zdroje

1. World Health Organization Regional Office for Europe 2010 Czech Republic Facts and Figures. http://www.euro.who.int/en/where-we-work/member-states/czech-republic/facts-and-figures. Accessed August 31 2010

2. GilmoreABMcKeeM 2004 Tobacco and transition: an overview of industry investments, impact and influence in the former Soviet Union. Tob Control 13 136 142

3. GilmoreABCollinJMcKeeM 2006 British American Tobacco's erosion of health legislation in Uzbekistan. BMJ 355 358

4. GilmoreABMcKeeM 2005 Exploring the impact of foreign direct investment on tobacco consumption in the former Soviet Union. Tob Control 14 13 21

5. GilmoreAFooksGMcKeeM 2011 A review of the impacts of tobacco industry privatisation: implications for policy. Glob Public Health 6 621 642

6. GilmoreAÖsterbergEHelomaAZatonskiWDelchevaE 2004 Free trade versus the protection of health: the examples of alcohol and tobacco. MacLehoseLMMNolteE Health Policy and European Union enlargement Open University Press 198 224

7. GuindonGETobinSYachD 2002 Trends and affordability of cigarette prices: ample room for tax increases and related health gains. Tob Control 11 35 43

8. JoossensLRawM 2011 The Tobacco Control Scale 2010 in Europe. Association of European Cancer Leagues. http://www.ensp.org/sites/default/files/TCS_2010_in_Europe_FINAL.pdf. Acessed 25 March 2011

9. ContigugliaC 2010 Philip Morris ČR expands despite EU - President Klaus on hand to cut ribbon, criticize regulation. The Prague Post. Prague & Online, 6 October: http://www.praguepost.com/business/5946-philip-morris-cr-expands-despite-eu.html. Accessed 28 March 2011

10. GilmoreACollinJTownsendJ 2007 Transnational tobacco company influence on tax policy during privatization of a state monopoly: British American Tobacco and Uzbekistan. Am J Public Health 97 2001 2009

11. World Health Organization Tobacco Free Initiative 2004 Building Blocks for Tobacco Control: a handbook Geneva World Health Organization

12. ReedH 2010 The Effects of Increasing Tobacco Taxation: A Cost Benefit and Public Finances Analyses. Action on Smoking and Health www.ash.org.uk/tax/analysis. Acessed 20 March 2011

13. World Health Organization 2010 Tobacco Fact Sheet. http://www.who.int/mediacentre/factsheets/fs339/en/index.html. Accessed 28 August 2010

14. The World Bank 1999 Curbing the Epidemic: Governments and the Economics of Tobacco Control Washington, DC The World Bank

15. World Health Organization 2010 WHO technical manual on tobacco tax administration. Geneva: WHO. http://whqlibdoc.who.int/publications/2010/9789241563994_eng.pdf. Acessed 30 January 2011

16. International Agency for Research on Cancer (IARC) 2011 Effectiveness of Tax and Price Policies for Tobacco Control. IARC Handbooks of Cancer Prevention in Tobacco Control, Volume 14 Lyon IARC

17. GilmoreA 2005 Tobacco and Transition: Understanding the impact of transition on tobacco use and control in the former Soviet Union [PhD thesis] London London School of Hygiene & Tropical Medicine

18. HillM 1993 Archival strategies and techniques Newbury Park, California Sage Publications

19. ForsterN 1994 CassellCSymonG The Analysis of Company Documentation London Sage Publications

20. RitchieJSpencerL 2002 Qualitative Data Analysis in Applied Policy Research. HubermanAMMM.B. The Qualitative Researcher's Companion London Sage

21. RitchieJSpencerLO'ConnorW 2004 Carrying out Qualitative Analysis. RitchieJLJ. Qualitative Research Practice: A Guide for Social Science Students and Researchers London Sage 219 262

22. WarnerA 1992 New Analysis: How Philip Morris Bought Czechoslovakia. Source: British American Tobacco. Bate(s) number: 301767929. http://legacy.library.ucsf.edu/tid/jpw80a99. Accessed 15 Jul 2010

23. WattertonDS 1991 Progress Report on New Business Development Projects. Source: British American Tobacco. Bate(s) number: 502599388-502599391. http://legacy.library.ucsf.edu/tid/nsr18a99. Accessed 21 Jul 2010

24. JonesL 1996 Les Jones Trip Notes: Visit to BAT Czech Republic 20–24 May 1996. Source: British American Tobacco. Bate(s) number: 700479700-700479709. http://legacy.library.ucsf.edu/tid/tld65a99. Accessed 16 Jul 2010

25. BuzziAG 1990 910000–930000 Three Year Plan. Source: Philip Morris. Bate(s) number: 2500010176/2500010185. http://legacy.library.ucsf.edu/tid/bpi42e00. Accessed 20 Jul 2010

26. BibleGCMilesMAMurrayRW 1992 Cigarette Manufacturing Investment in Czechoslovakia. Source: Philip Morris. Bate(s) number: 2048071043/2048071047. http://legacy.library.ucsf.edu/tid/cxr82e00. Accessed 08 Jun 2010

27. Anonymous 1993 [No Title]. Source: Philip Morris. Bate(s) number: 2500100123/2500100231. http://legacy.library.ucsf.edu/tid/rwd42e00. Accessed 25 Jul 2010

28. Anonymous 1991 910000 Revised Forecast 910606 Presentation on Eastern Europe. Source: Philip Morris. Bate(s) number: 2500058044/2500058090. http://legacy.library.ucsf.edu/tid/edf42e00. Accessed 21 Jul 2010

29. Anonymous [undated] Excise Conference. Source: British American Tobacco. Bate(s) number: 900007443-900007455. http://legacy.library.ucsf.edu/tid/epn63a99. Accessed 05 Aug 2010

30. Anonymous 1992 Response by BATCo to the Investment Questionnaire. Source: British American Tobacco. Bate(s) number: 201503910-201503928. http://legacy.library.ucsf.edu/tid/qyf10a99. Accessed 22 Jul 2010

31. BenwellD 1990 Group Strategy Review Data. Source: British American Tobacco. Bate(s) number: 300047360-300047493. http://legacy.library.ucsf.edu/tid/twl08a99. Accessed 05 Aug 2011

32. Anonymous 1991 Czechoslovakia - Cigarette Market: Report of a Market Visit. Source: British American Tobacco. Bate(s) number: 203459674-203459716. http://legacy.library.ucsf.edu/tid/jjb61a99. Accessed 05 Aug 2011

33. Anonymous 1992 SECRET Ew BUSE 'E$$ DEVELOPMENT PROGRESS REPORT - APRIL 1992 CZECHOSLOVAKIA i CSTP (Slovakia) CSTP. Source: Research. Bate(s) number: 06930014. http://legacy.library.ucsf.edu/tid/dsv96b00. Accessed 17 Jul 2010

34. MilesMAMurrayW 1992 PM Quarterly. Source: Philip Morris. Bate(s) number: 2040714643/2040714658. http://legacy.library.ucsf.edu/tid/wri72e00. Accessed 13 Feb 2011

35. Anonymous 1992 Philip Morris Companies, Inc. Competitive Intelligence Profile. Source: Philip Morris. Bate(s) number: 2040707900/2040707940. http://legacy.library.ucsf.edu/tid/nqd66e00. Accessed 23 Jul 2010

36. EdmondsonR 1993 Czech Tobacco Market. Source: British American Tobacco. Bate(s) number: 202030034-202030038. http://legacy.library.ucsf.edu/tid/fqj31a99. Accessed 08 Jun 2010

37. GemblerA 1991 Margaret Thatcher. Source: Philip Morris. Bate(s) number: 2073893364/2073893365. http://legacy.library.ucsf.edu/tid/lpo37c00. Accessed 21 Jul 2010

38. BrookesNG 1992 New Business Development - Monthly Report to Mid-December 1992. Source: British American Tobacco. Bate(s) number: 202706644-202706650. http://legacy.library.ucsf.edu/tid/lgr87a99. Accessed 25 Jul 2010

39. Anonymous 1993 BAT Industries Plc: Report on Lobbying Visit 12th to 15th April, 1993. Source: British American Tobacco. Bate(s) number: 203838762-203838794. http://legacy.library.ucsf.edu/tid/jfj80a99. Accessed 25 Aug 2010

40. Anonymous [undated] Report on cigarette manufacture in the Czech Republic. Source: British American Tobacco. Bate(s) number: 203838816-203838827. http://legacy.library.ucsf.edu/tid/cgj80a99. Accessed 17 Jul 2010

41. van WaayA 1993 Czechlands. Source: British American Tobacco. Bate(s) number: 301767914. http://legacy.library.ucsf.edu/tid/apw80a99. Accessed 15 Jul 2010

42. van WaayT 1993 Letter from Ton van Waay to Jan Cerny regarding tobacco production monopoly legislation. Source: British American Tobacco. Bate(s) number: 500053894-500053895. http://legacy.library.ucsf.edu/tid/gmx52b00 Accessed 26 Jul 2010

43. Anonymous 1993 Report on Second Lobbying Visit - to Prague on 21st and 22nd January, 1993. Source: British American Tobacco. Bate(s) number: 203838840-203838866. http://legacy.library.ucsf.edu/tid/fgj80a99. Accessed 26 Jul 2010

44. Anonymous 1993 Report on Second Lobbying Visit - to Prague and Brno on 15th and 16th February, 1993. Source: British American Tobacco. Bate(s) number: 203838828-203838838. http://legacy.library.ucsf.edu/tid/dgj80a99 Accessed 26 Jul 2010

45. BrookesNG 1993 Czech Republic and Slovakia. Source: British American Tobacco. Bate(s) number: 202214399-202214403. http://legacy.library.ucsf.edu/tid/unm48a99. Accessed 15 Jul 2010

46. HoweT 1993 Czech Republic. Source: British American Tobacco. Bate(s) number: 203839067-203839085. http://legacy.library.ucsf.edu/tid/fhj80a99. Accessed 08 Jun 2010

47. HoweT 1993 Note from Tom Howe to Tom Van Waay Regarding Enclose a Translation of the Draft Act on Tobacco. Source: British American Tobacco. Bate(s) number: 203839037-203839054. http://legacy.library.ucsf.edu/tid/xgj80a99. Accessed 08 Jun 2010

48. Anonymous 1994 Central Europe 940000 Ob Presentation. Source: Philip Morris. Bate(s) number: 2024152858/2024153034. http://legacy.library.ucsf.edu/tid/rmm42e00. Accessed 31 Jul 2010

49. HoweT 1993 Note from Tom Howe to Ton Van Waay regarding draft tobacco law. Source: British American Tobacco. Bate(s) number: 203839056. http://legacy.library.ucsf.edu/tid/zgj80a99. Accessed 08 Jun 2010

50. Anonymous 1995 Company Plan - 1996–1998. Source: British American Tobacco. Bate(s) number: 502612130-502612239. http://legacy.library.ucsf.edu/tid/cng08a99. Accessed 04 Aug 2010

51. Anonymous 1996 Tender Proposal by BAT Industries to the Government of the Republic of Moldova in Joint Stock Company Tutun SA with the Government of the Republic of Moldova. Source: British American Tobacco. Bate(s) number: 800198427-800198472. http://legacy.library.ucsf.edu/tid/dpq71a99. Accessed 05 Aug 2011

52. Anonymous 1993 Czech and Slovak Republics 940000 Marketing Plan. Source: Philip Morris. Bate(s) number: 2501262636/2501262765. http://legacy.library.ucsf.edu/tid/wii49e00. Accessed 16 Jul 2010

53. Anonymous 1994 Three Year Plan 940000–960000 Philip Morris Eema Region. Source: Philip Morris. Bate(s) number: 2500070001/2500070153. http://legacy.library.ucsf.edu/tid/dhr02a00. Accessed 30 Jun 2011

54. Anonymous 1995 U.S. CIGARETTE PRODUCTION UP 10 PERCENT IN 940000. Source: Philip Morris. Bate(s) number: 2071988216/2071988217. http://legacy.library.ucsf.edu/tid/cch08d00. Accessed 09 Aug 2011

55. Anonymous 1993 CIGARETTES ARE SMUGGLED ALSO WITHIN EUROPEAN COMMUNITIES FISCAL STAMPS WOULD HELP. Source: Philip Morris. Bate(s) number: 2501146847. http://legacy.library.ucsf.edu/tid/mue32e00. Accessed 09 Aug 2011

56. Anonymous 1994 PHILIP MORRIS COMPANIES INC. FIVE YEAR PLAN 940000–980000. Source: Philip Morris. Bate(s) number: 2024153931/2024154187. http://legacy.library.ucsf.edu/tid/uhd12a00. Accessed 09 Aug 2011

57. Anonymous 1993 Competitor/Brand News. Source: British American Tobacco. Bate(s) number: 400556212-400556218. http://legacy.library.ucsf.edu/tid/jwi62a99. Accessed 05 Aug 2011

58. Anonymous [undated] Czechoslovakia - Cigarette Market: Report of a Market Visit. Source: British American Tobacco. Bate(s) number: 203459674-203459716. http://legacy.library.ucsf.edu/tid/jjb61a99. Accessed 05 Aug 2011

59. ERC Group Ltd 2006 World Cigarettes (Czech Republic) Suffolk, UK ERC Group Ltd 1 41

60. AndradeAJ 1993 Proposed Visits by Dr. Marcovitch to Select Eema Markets to Discuss Monitoring of Proposed Laws and Regulations Addressing Technical Issues. Source: Philip Morris. Bate(s) number: 2025601608/2025601610. http://legacy.library.ucsf.edu/tid/mtp25e00. Accessed 30 Jun 2011

61. MeyerS 1997 New Players for the Old Tobacco Game: the Czech Republic and Romania; It's Time to Change the Rules. Northwestern Journal of International Law & Business 17 1057 1090

62. FauciC 1993 Cigarette Makers Find Loopholes in Czech Ad Ban. Source: Philip Morris. Bate(s) number: 2501146848. http://legacy.library.ucsf.edu/tid/nue32e00. Accessed 29 Jul 2011

63. Anonymous 1993 Typ 940000–960000 - Sgc, 930900 Eema Regional Corporate Affairs. Source: Philip Morris. Bate(s) number: 2500118564/2500118584. http://legacy.library.ucsf.edu/tid/mek19e00. Accessed 27 Jul 2010

64. Anonymous 1993 Statement for the Media Czech Republic. Source: Philip Morris. Bate(s) number: 2501098501/2501098502. http://legacy.library.ucsf.edu/tid/ffi22d00. Accessed 30 Jun 2011

65. Anonymous 1992 Czech and Slovak Federated Republic Proposed Voluntary Advertising Code of Conduct. Source: Philip Morris. Bate(s) number: 2500080373. http://legacy.library.ucsf.edu/tid/rtc42e00. Accessed 30 Jun 2011

66. GreenbergDRozenP 1993 Corporate Affairs Weekly Highlights - 931101–931108. Source: Philip Morris. Bate(s) number: 2500064866/2500064869. http://legacy.library.ucsf.edu/tid/jve42e00. Accessed 30 Jun 2011

67. Anonymous 1993 Central Europe 940000 Ob Presentation. Source: Philip Morris. Bate(s) number: 2500107969/2500108065. http://legacy.library.ucsf.edu/tid/pfd42e00. Accessed 16 Feb 2011

68. Anonymous 1991 Corporate Affairs. Source: Philip Morris. Bate(s) number: 2501146354/2501146369. http://legacy.library.ucsf.edu/tid/fcu39e00. Accessed 29 Jul 2011

69. FriedmanLC 2006 Tobacco industry use of judicial seminars to influence rulings in products liability litigation. Tob Control 15 120 124

70. WhistA 1993 [No Title]. Source: Philip Morris. Bate(s) number: 2024210559/2024210560. http://legacy.library.ucsf.edu/tid/ytn46e00. Accessed 29 Jul 2011

71. LukavskaL 1993 Commercial Free Speech Is Basic Human Right - Regulation of Advertising Is Undesirable. Source: Philip Morris. Bate(s) number: 2024210561. http://legacy.library.ucsf.edu/tid/ztn46e00. Accessed 29 Jul 2011

72. AlblovaP 1993 Libertad Defends Freedom of Speech. Source: Philip Morris. Bate(s) number: 2024210564. http://legacy.library.ucsf.edu/tid/utn46e00. Accessed 29 Jul 2011

73. Anonymous 1992 East Europe Working Group: Minutes of Meeting Held in Prague on 6th February 1992. Source: British American Tobacco. Bate(s) number: 203471302-203471307. http://legacy.library.ucsf.edu/tid/ens54a99. Accessed 29 Jul 2011

74. RichardsJWTyeJBFischerPM 1996 The Tobacco Industry's Code of Advertising in the United States: Myth and Reality. Tob Control 5 295 311

75. Anonymous 1994 Three Year Plan 940000–960000 Philip Morris Eema Region. Source: Philip Morris. Bate(s) number: 2500070154/2500070218. http://legacy.library.ucsf.edu/tid/ehr02a00. Accessed 30 Jun 2011

76. Anonymous 1994 Three Year 940000–960000 Philip Morris Eema Region. Source: Philip Morris. Bate(s) number: 2500065216/2500065375. http://legacy.library.ucsf.edu/tid/zgr02a00. Accessed 30 Jun 2011

77. Anonymous 1992 Czech Advertising Story. Source: Philip Morris. Bate(s) number: 2051815625/2051815629. http://legacy.library.ucsf.edu/tid/mov51b00. Accessed 30 Jun 2011

78. AveryFFKeenanJMKiltsJMMacdonoughJNMayerRP 1994 Monthly Directors Report 940200. Source: Philip Morris. Bate(s) number: 2048035816/2048035911. http://legacy.library.ucsf.edu/tid/nbq92e00. Accessed 07 Dec 2011

79. Anonymous 1994 Corporate Affairs Weekly Highlights 940131–940204. Source: Philip Morris. Bate(s) number: 2022805856/2022805862. http://legacy.library.ucsf.edu/tid/jnx25e00. Accessed 07 Dec 2011

80. Anonymous 1994 Czechia - Philip Morris Under Fire for Lobbying. Source: British American Tobacco. Bate(s) number: 500334736-500334743. http://legacy.library.ucsf.edu/tid/sci50a99. Accessed 01 May 2011

81. Annonymous 1994 Philip Morris Companies Inc. 940000–980000 Five Year Plan. Source: Philip Morris. Bate(s) number: 2048383991/2048384095. http://legacy.library.ucsf.edu/tid/cgf82e00. Accessed 07 Dec 2011

82. Annonymous 1994 [No Title]. Source: Philip Morris. Bate(s) number: 2065423357/2065423381. http://legacy.library.ucsf.edu/tid/eje73c00. Accessed 07 Dec 2011

83. VirendraS 1995 Presentation. Source: Philip Morris. Bate(s) number: 2044046627A. http://legacy.library.ucsf.edu/tid/bxi87d00. Accessed 07 Dec 2011

84. MikesJ 1995 Letter from Jiri Mikes to Ales Janku regarding financial assistance to the Council for Advertising. Source: British American Tobacco. Bate(s) number: 700556665. http://legacy.library.ucsf.edu/tid/ewp71a99. Accessed 07 Dec 2011

85. Anonymous 1997 Report on Recent International Developments. Source: British American Tobacco. Bate(s) number: 321799743-321799983. http://legacy.library.ucsf.edu/tid/mkq53a99. Accessed 29 Jul 2011

86. Anonymous 1995 Marketing Plan 1996: Czech Republic/Slovak Republic. Source: British American Tobacco. Bate(s) number: 700479902-700479971. http://legacy.library.ucsf.edu/tid/wld65a99. Accessed 04 Aug 2010

87. BarkerABeestonRDixonRWattS 1996 Full Texts on E. European Smoking Policy. Source: Philip Morris. Bate(s) number: 2501127071/2501127118. http://legacy.library.ucsf.edu/tid/zsa55d00. Accessed 29 Jul 2011

88. RJR International 1995 R. J. Reynolds Tobacco International. Weekly Ceo Communication. Source: RJ Reynolds. Bate(s) number: 516540786/516540788. http://legacy.library.ucsf.edu/tid/cev03a00. Accessed 29 Jul 2011

89. Anonymous 1993 930000–970000 Strategic Plan. Source: Philip Morris. Bate(s) number: 2024162027/2024162059. http://legacy.library.ucsf.edu/tid/xqm42e00. Accessed 26 Jul 2010

90. Anonymous 1994 Summary of Operating Plans. Source: Philip Morris. Bate(s) number: 2024341565/2024341586. http://legacy.library.ucsf.edu/tid/ikm09e00. Accessed 29 Jul 2010

91. Anonymous 1998 [No Title]. Source: Philip Morris. Bate(s) number: 2079037818/2079037853. http://legacy.library.ucsf.edu/tid/xvb47c00. Accessed 05 Aug 2010

92. CarlsonG 1992 EEWG/Warsaw Meeting September 8, 1993. Source: British American Tobacco. Bate(s) number: 301640945-301640956. http://legacy.library.ucsf.edu/tid/zik07a99. Accessed 24 Jul 2010

93. Anonymous 1992 Philip Morris Strategic Highlights May TSRT Meeting. Source: British American Tobacco. Bate(s) number: 202227185-202227188. http://legacy.library.ucsf.edu/tid/aal40a99. Accessed 21 Jul 2010

94. MilesMAMurrayW 1993 Pm Quarterly. Source: Philip Morris. Bate(s) number: 2040714659/2040714674. http://legacy.library.ucsf.edu/tid/xri72e00. Accessed 27 Jul 2010

95. BartonHC 1993 New Business Development Strategy. Source: British American Tobacco. Bate(s) number: 202700033-202700054. http://legacy.library.ucsf.edu/tid/nat77a99. Accessed 26 Jul 2010

96. BartonHC 1993 BAT Industries Tobacco Strategy. Source: British American Tobacco. Bate(s) number: 202241835-202241858. http://legacy.library.ucsf.edu/tid/urn01a99. Accessed 27 Jul 2010

97. MikšíckováJ in press A tax chapter. Závislost na tabáku - epidemiologie, prevence a lécba (Tobacco Dependence – Epidemiology, Prevention and Treatment) Prague, Czech Republic the Ministry of Finance, Czech Republic

98. Anonymous 1995 Philip Morris Companies Inc. Five Year Plan 950000–990000. Source: Philip Morris. Bate(s) number: 2048560100/2048560188. http://legacy.library.ucsf.edu/tid/uvo72e00. Accessed 31 Jul 2010

99. BinghamP 1988 Tobacco Strategy Review Team - EEC Single Internal Market: 1992. Source: British American Tobacco. Bate(s) number: 301529940-301529944. http://legacy.library.ucsf.edu/tid/hmb08a99. Accessed 27 Aug 2011

100. BinghamPM 1989 The European Community: The Single Market 1992. Source: British American Tobacco. Bate(s) number: 201769674-201769715. http://legacy.library.ucsf.edu/tid/mtd40a99. Accessed 27 Aug 2011

101. Annonymous 1989 The European Community: The Single Market 1992. Source: British American Tobacco. Bate(s) number: 201798484-201798525. http://legacy.library.ucsf.edu/tid/ima20a99. Accessed 01 Sep 2011

102. ManciniE 1991 Note from Elaine Mancini to David Bacon regarding the meeting to be held in London. Source: British American Tobacco. Bate(s) number: 304042937-304042941. http://legacy.library.ucsf.edu/tid/kvp81a99. Accessed 21 Jul 2010

103. WhitehouseA 1991 Note of a Meeting with Mr Antonin Kalina of the Federal Ministry of Finance in Prague held on 18th December 1991. Source: British American Tobacco. Bate(s) number: 301134951. http://legacy.library.ucsf.edu/tid/epk51a99. Accessed 15 Jul 2010

104. Anonymous 1992 Report on a visit to Czechoslovakia February 3–7 and February 17–18. Source: British American Tobacco. Bate(s) number: 301768023-301768066. http://legacy.library.ucsf.edu/tid/uqw80a99. Accessed 17 Jul 2010

105. SzilagyiTChapmanS 2003 Tobacco industry efforts to keep cigarettes affordable: a case study from Hungary. Cent Eur J Public Health 11 223 228

106. KramerJE 1992 Three Year Plan 920000–940000 Philip Morris Eema Region. Source: Philip Morris. Bate(s) number: 2040708337/2040708471. http://legacy.library.ucsf.edu/tid/qel72e00. Accessed 29 Jul 2010

107. Anonymous 1993 No Title. Source: Philip Morris. Bate(s) number: 2045979119/2045979251. http://legacy.library.ucsf.edu/tid/lnm50b00. Accessed 16 Feb 2011

108. BuzziAG 1992 930000–950000 Three Year Plan. Source: Philip Morris. Bate(s) number: 2500070659/2500070666. http://legacy.library.ucsf.edu/tid/nwi19e00. Accessed 24 Jul 2010

109. BatesT 1994 International Brand Report 1988–1992. Source: British American Tobacco. Bate(s) number: 503913060-503913108. http://legacy.library.ucsf.edu/tid/kui31a99. Accessed 09 Nov 2011

110. Annonymous 1994 Product Innovation - The Case for Short Cigarettes. Source: British American Tobacco. Bate(s) number: 403684937. http://legacy.library.ucsf.edu/tid/mej77a99. Accessed 09 Nov 2011

111. Anonymous 1995 Pmi Three Year Plan Protecting the Industry and Smoker. Source: Philip Morris. Bate(s) number: 2071284727/2071284741. http://legacy.library.ucsf.edu/tid/xlq08d00. Accessed 01 Aug 2010

112. de VroeyF 1997 Meeting CETTF 28th January. Source: British American Tobacco. Bate(s) number: 900007473-900007474. http://legacy.library.ucsf.edu/tid/ipn63a99. Accessed 05 Aug 2010

113. ReaveyRP 1996 Note from Richard P Reavey regarding minutes of the Central Europe tax task force meeting. Source: British American Tobacco. Bate(s) number: 900007540-900007544. http://legacy.library.ucsf.edu/tid/upn63a99. Accessed 04 Aug 2010

114. Anonymous 1998 Industry Meeting October 23, 1998: Summary of the Main Points. Source: British American Tobacco. Bate(s) number: 321214640-321214641. http://legacy.library.ucsf.edu/tid/aip44a99. Accessed 05 Aug 2010

115. BradyB 1993 East European Working Group. Source: British American Tobacco. Bate(s) number: 502597130-502597132. http://legacy.library.ucsf.edu/tid/rnb08a99. Accessed 27 Jul 2010

116. MadsenPT 1993 Minutes of EEWG-Meeting. Source: British American Tobacco. Bate(s) number: 503078371-503078374. http://legacy.library.ucsf.edu/tid/vsk87a99. Accessed 27 Jul 2010

117. Anonymous 1996 Draft Minutes Meeting Held in Brussels: 15/10/1996. Source: British American Tobacco. Bate(s) number: 900007551-900007552. http://legacy.library.ucsf.edu/tid/vpn63a99. Accessed 05 Aug 2010

118. ReaveyRP 1996 Note from Richard P Reavey regarding CETTF meeting. Source: British American Tobacco. Bate(s) number: 900007524-900007526. http://legacy.library.ucsf.edu/tid/ppn63a99. Accessed 04 Aug 2010

119. Anonymous 1997 Draft Minutes Meeting Held in Brussels: 15/10/1996. Source: British American Tobacco. Bate(s) number: 900007469-900007470. http://legacy.library.ucsf.edu/tid/hpn63a99. Accessed 08 Jun 2010

120. Anonymous 1996 Central/Eastern Europe Working Group Meeting. Source: British American Tobacco. Bate(s) number: 900007720-900007726. http://legacy.library.ucsf.edu/tid/drn63a99. Accessed 04 Aug 2010

121. GilmoreAMcKeeM 2004 Tobacco-control policy in the European Union. FeldmanEBayerR Unfiltered: Conflicts over tobacco policy and public health Cambridge, MA Harvard University Press 219 254

122. SpielmanA 2008 The Startling Business of Tobacco. Citigroup Smith Barney

123. Morgan Stanley Research Europe 2007 Tobacco - Late to the Party London Morgan Stanley

124. GilmoreABBranstonJRSweanorD 2010 The case for OFSMOKE: how tobacco price regulation is needed to promote the health of markets, government revenue and the public. Tob Control 19 423 430

125. MamuduHMHammondRGlantzS 2008 Tobacco industry attempts to counter the World Bank report curbing the epidemic and obstruct the WHO framework convention on tobacco control. Soc Sci Med 67 1690 1699

126. Anonymous 2000 Public Finance Balance of Smoking in the Czech Republic. Source: Philip Morris. Bate(s) number: 2085293756/2085293783. http://legacy.library.ucsf.edu/tid/jxn10c00. Accessed 16 Jul 2010

127. Anonymous 2001 U.S Exhibit 45,700, Press, “AD Little Czech Republic Study Media Coverage” ARTHUR D. LITTLE INC., PHILIP MORRIS INC., July 24–26, 2001. Source: Datta. Bate(s) number: USX1511376-USX1511408. http://legacy.library.ucsf.edu/tid/nxu36b00. Accessed 13 Sep 2010

128. SwogerK 2001 Report says smoking has benefits: Report concludes that smoking is good for government finances. The Prague Post. Prague & Online, 27 June: http://www.praguepost.cz/news062701g.html. Accessed 15 March 2011

129. RossH 2004 Critique of the Philip Morris study of the cost of smoking in the Czech Republic. Nicotine Tob Res 6 181 189

130. Anonymous 1999 ‘Smoking Benefits the Economy’ Claim. Source: Philip Morris. Bate(s) number: 2085791613A/2085791614. http://legacy.library.ucsf.edu/tid/lpl20c00. Accessed 06 Aug 2010

131. FaircloughG 2001 Smoking Can Help Czech Economy, Philip Morris-Little Report Says. The Wall Street Journal. Prague & Online, 17 July: http://online.wsj.com/article/SB995230746855683470.html. Accessed 15 March 2011

132. TapieMN 2001 Newsedge 7/27/01. Source: Philip Morris. Bate(s) number: 5001087639/5001087647. http://legacy.library.ucsf.edu/tid/jtv07a00. Accessed 06 Aug 2010

133. KaplanR 2001 Draft Response to Shareholders on Czech Economic Impact Study. Source: Philip Morris. Bate(s) number: 2085774511D/2085774512. http://legacy.library.ucsf.edu/tid/idv41c00. Accessed 16 Jul 2010

134. ParrishS 1996 Five Year Plan 960000–200000. Source: Philip Morris. Bate(s) number: 2048310635/2048310954. http://legacy.library.ucsf.edu/tid/jve22d00. Accessed 04 Aug 2010

135. BartonHC 1996 British American Tobacco (Holding) Key Issues Meeting. Source: British American Tobacco. Bate(s) number: 800378241-800378246. http://legacy.library.ucsf.edu/tid/kcu50a99. Accessed 05 Aug 2010

136. BubnikG 1998 Fax Message. Gifts to Political Parties. Source: Philip Morris. Bate(s) number: 2084208229. http://legacy.library.ucsf.edu/tid/ckn61b00. Accessed 27 Jul 2010

137. LewinterDJ 1996 Political Contributions - Czech Republic. Source: Philip Morris. Bate(s) number: 2047848228. http://legacy.library.ucsf.edu/tid/mmj74a00. Accessed 04 Aug 2010

138. AdkinsCBibleGCBringMFergusonKIGemblerA 1998 Request for Approval of Political Contribution, Per Pmi G-105, Policy G-114. Source: Philip Morris. Bate(s) number: 2084208226/2084208227. http://legacy.library.ucsf.edu/tid/bkn61b00. Accessed 27 Jul 2010

139. Anonymous 1998 Czech Republic: Still Unclear Who Founded Oda Offshore Company. Source: Philip Morris. Bate(s) number: 2077255202. http://legacy.library.ucsf.edu/tid/ovb85c00. Accessed 08 Aug 2011

140. TerraJ 2002 Political Parties, Party Systems and Economic Reform: Testing Hypotheses against Evidence from Postcommunist Countries. Czech Sociol Rev 3 277 296

141. Anonymous 2000 Tobacco Transnationals, Political Influence, and the Who. Source: Philip Morris. Bate(s) number: 2081380616/2081380617. http://legacy.library.ucsf.edu/tid/lnw65c00. Accessed 08 Aug 2011